Quest Diagnostics 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 20

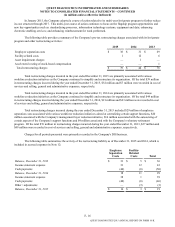

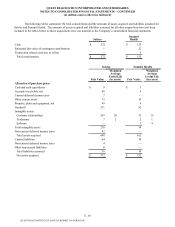

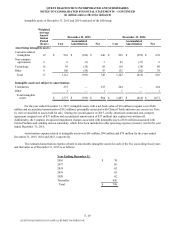

Pro Forma Combined Financial Information

The following unaudited pro forma combined financial information reflects the consolidated statement of operations of

the Company as if the acquisitions of Solstas and Summit Health had occurred as of January 1, 2013. The unaudited pro forma

information includes adjustments primarily related to the amortization of intangible assets acquired, interest expense associated

with debt extinguished prior to the acquisitions, and transaction costs related to the Solstas and Summit Health acquisitions.

The unaudited pro forma combined financial information does not include the estimated annual synergies expected to be

realized upon completion of the integration of Solstas and Summit Health and is not indicative of the results of operations as

they would have been had the transaction been effected on the assumed date. Pre-acquisition financial information for all other

acquisitions has not been included in the table below as these acquisitions were not material to the Company’s consolidated

financial statements.

2014 2013

(unaudited)

Pro forma net revenues $ 7,520 $ 7,622

Pro forma income from continuing operations $ 585 $ 855

Earnings per share attributable to Quest Diagnostics’ common stockholders - basic:

Pro forma income from continuing operations $ 3.79 $ 5.40

Earnings per share attributable to Quest Diagnostics’ common stockholders - diluted:

Pro forma income from continuing operations $ 3.77 $ 5.36

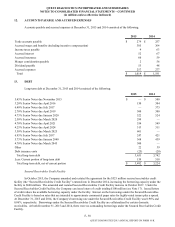

6. DISPOSITIONS AND HELD FOR SALE

Dispositions

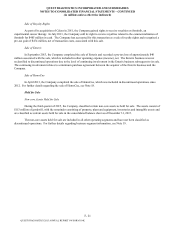

Contribution of Clinical Trials Business

On March 30, 2015, the Company entered into a definitive agreement with Quintiles Transnational Holdings Inc. to

form a global clinical trials central laboratory services joint venture, Q2 Solutions. The transaction closed on July 1, 2015. In

connection with the transaction, the Company contributed certain assets of its clinical trials testing business ("Clinical Trials")

and a net $33 million of cash to the newly formed joint venture in exchange for a non-controlling, 40% ownership interest. The

assets of Clinical Trials contributed to the joint venture, principally consisting of property, plant and equipment and goodwill,

were classified as assets held for sale in the first quarter of 2015 and were contributed to Q2 Solutions upon closing of the

transaction. Subsequent to closing, the Company's ownership interest in the joint venture is being accounted for under the

equity method of accounting. At December 31, 2015, the investment in Q2 Solutions had a carrying value of $416 million.

During the third quarter of 2015, the Company recognized a pre-tax gain of $334 million based on the difference

between the fair value of the Company's equity interest in the newly formed joint venture over the carrying value of the assets

contributed. The fair value of the Company's equity interest was determined using discounted cash flows. In connection with

the gain, the Company recorded a deferred tax liability of $145 million. Upon formation, the Company's investment in Q2

Solutions exceeded its equity in the underlying net assets by approximately $219 million. This basis difference is attributable to

finite-lived assets, indefinite-lived intangible assets and goodwill of the joint venture. The basis difference associated with the

finite-lived assets of $75 million is being amortized over a weighted average useful life of 8 years as a reduction to the carrying

value of the investment in equity method investees and corresponding reduction in equity in earnings of equity method

investees, net of taxes.

Clinical Trials, prior to July 1, 2015, is included in all other operating segments and has not been classified as

discontinued operations. For further details regarding business segment information, see Note 19.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K