Quest Diagnostics 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 12

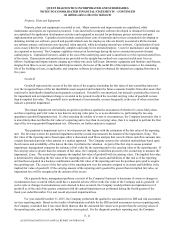

performed step one of the goodwill impairment test and concluded that goodwill of the reporting unit was not impaired. For the

year ended December 31, 2014, the Company elected to bypass the qualitative assessment, performed step one of the goodwill

impairment test for all of its reporting units and concluded that goodwill of each reporting unit was not impaired.

Intangible Assets

Intangible assets are recognized at fair value, as an asset apart from goodwill if the asset arises from contractual or

other legal rights, or if it is separable. Intangible assets, principally representing the cost of customer-related intangibles, non-

competition agreements and technology acquired, are capitalized and amortized on the straight-line method over their expected

useful life, which generally ranges from five to twenty years. Intangible assets with indefinite useful lives, consisting

principally of acquired tradenames, are not amortized, but instead are periodically reviewed for impairment.

The Company reviews indefinite-lived intangible assets periodically for impairment and an impairment charge is

recorded in the periods in which the recorded carrying value of indefinite-lived intangibles is more than its estimated fair

value. The indefinite-lived intangible asset impairment test is performed at least annually, or more frequently in the case of

other events that indicate a potential impairment.

Based upon the Company’s most recent annual impairment tests completed during the fourth quarter of the years

ended December 31, 2015 and 2014, the Company concluded that indefinite-lived intangible assets were not impaired.

The Company reviews the recoverability of its long-lived assets (including amortizable intangible assets), other than

goodwill and indefinite-lived intangible assets, when events or changes in circumstances occur that indicate that the carrying

value of the asset may not be recoverable. Evaluation of possible impairment is based on the Company's ability to recover the

asset from the expected future pre-tax cash flows (undiscounted and without interest charges) of the related operations. If the

expected undiscounted pre-tax cash flows are less than the carrying amount of such asset, an impairment loss is recognized for

the difference between the estimated fair value and carrying amount of the asset.

Investments

The Company's investments, which are included in other assets in the consolidated balance sheets, are comprised of

trading securities, available-for-sale securities and other investments. The classification of an investment depends on our intent

and ability to hold the investment.

• Trading securities represent participant-directed investments of deferred employee compensation and related Company

matching contributions held in trusts pursuant to the Company's supplemental deferred compensation plans (see Note

16). Trading securities are carried at fair value with both realized and unrealized gains and losses recorded currently in

earnings as a component of non-operating expenses within other (expense) income, net in the consolidated statements

of operations. For the years ended December 31, 2015, 2014 and 2013, gains from trading equity securities totaled $0

million, $3 million, and $7 million, respectively.

• Available-for-sale equity securities consists of an investment in registered shares of a public corporation. Available-

for-sale equity securities are carried at fair value with unrealized gains and losses, net of tax, recorded as a component

of accumulated other comprehensive loss within stockholders' equity and realized gains and losses recorded in other

(expense) income, net in the consolidated statements of operations. At December 31, 2015, the Company had gross

unrealized losses from available-for-sale equity securities of $2 million.

• Other investments do not have readily determinable fair values and consist of investments in preferred and common

shares of privately held companies and are accounted for under the cost method.

Gains and losses on securities sold are based on the average cost method. The Company periodically reviews its

investments to determine whether a decline in fair value below the cost basis is other-than-temporary. The primary factors

considered in the determination are: the length of time that the fair value of the investment is below carrying value; the financial

condition, operating performance and near-term prospects of the investee; and the Company's intent and ability to hold the

investment for a period of time sufficient to allow for a recovery in fair value. If the decline in fair value is deemed to be other-

than-temporary, the cost basis of the security is written down to fair value.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K