Quest Diagnostics 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

Five-point Strategy

We made good progress on the execution of our five-point strategy during 2015 as follows:

• We have seen continued growth in our gene-based and esoteric testing.

• We acquired MemorialCare Health System's laboratory outreach services business and the business assets of Superior

Mobile Medics, Inc. ("Superior Mobile Medics"), which operated in the risk assessment business. In addition, we

announced that we entered into a definitive agreement to acquire the outreach laboratory service business of Clinical

Laboratory Partners.

• We entered into an agreement to provide professional lab services for Barnabas Health, New Jersey's largest not-for-

profit integrated healthcare delivery system.

• We announced a partnership with Inovalon to deliver our Data Diagnostics Solutions offering, as part of our new

Quanum solutions suite, which generates further value from our information assets by delivering real time insights to

physicians at the point of service.

• Our cost excellence program, Invigorate, delivered realized savings of more than $200 million in 2015.

• We closed on our Q2 Solutions joint venture with Quintiles Transnational Holdings Inc. ("Quintiles"), which is an

important element of our growth strategy along with our other equity method investees.

• We completed a $1.2 billion senior notes offering and used the proceeds to retire over $1.2 billion in outstanding

senior notes resulting in reduced future interest expense and an improved maturity profile.

• We repurchased approximately $224 million of our common stock as part of our share repurchase program and paid

dividends to our shareholders of $212 million.

• On January 28, 2016, we announced that our Board of Directors authorized a 5% increase in our quarterly dividend

from $0.38 per share to $0.40 per share, or $1.60 annually, commencing with the dividend payable in April 2016.

For additional information on our five-point strategy, see Item 1: "Our Strategy and Strengths."

Outlook and Trends

The healthcare system in the United States is evolving; significant change is taking place in the system. We expect

that the evolution of the healthcare industry will continue, and that industry change is likely to be extensive. There are a

number of key trends that are having, and that we expect will continue to have, a significant impact on the diagnostic

information services business in the United States and on our business. These trends present both opportunities and risks.

However, because diagnostic information services is an essential healthcare service and because of the key trends discussed

below, we believe that the industry will continue to grow over the long term and that we are well positioned to benefit from the

long-term growth expected in the industry.

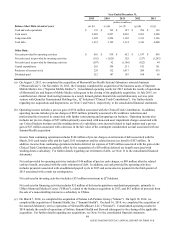

We expect to see a stable business environment in 2016, and we expect reimbursement pressure for our DIS business

will be moderate through 2017. However, healthcare market participants in the United States, including governments, are

focused on controlling healthcare costs through means including but not limited to shifting from fee for service to capitation,

changing medical coverage policies (e.g., healthcare benefit design), pre-authorization of lab testing, requiring co-pays,

introducing lab spend management utilities and payment and patient care innovations such as ACOs and patient-centered

medical homes. As health plans and government programs require greater levels of patient cost-sharing, our patient collections

could be negatively impacted and adversely impact our bad debt expense. As previously mentioned, there could be a shift to

capitation arrangements where we agree to a predetermined monthly reimbursement rate for each member enrolled in a

restricted plan, generally regardless of the number or cost of services provided by us. In 2015 and 2014, we derived

approximately 11% of our testing volume and 4% and 3%, respectively, of our DIS revenues from capitated payment

arrangements.

Historically, the Medicare Clinical Laboratory Fee Schedule and the Medicare Physician Fee Schedule established

under Part B of the Medicare program have been subject to change, including each year. In addition, pursuant to the federal

Protecting Access to Medicare Act of 2014 ("PAMA"), it is expected that the Centers for Medicare and Medicaid Services will

revise reimbursement schedules for clinical laboratory testing services provided under Medicare. We expect the revised

reimbursement schedules as a result of PAMA to become effective as early as 2017. In 2015, approximately 12% of our

consolidated net revenues were reimbursed by Medicare under the Clinical Laboratory Fee Schedule and approximately 2%

were reimbursed by Medicare under the Physician Fee Schedule.

The FDA has announced guidance initiatives that may impact the clinical laboratory testing business, including by

increasing regulation of laboratory-developed tests. In addition, the trend of consolidating, converging and diversifying among

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K