Quest Diagnostics 2015 Annual Report Download - page 92

Download and view the complete annual report

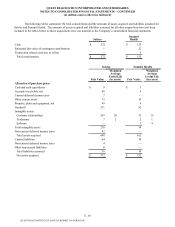

Please find page 92 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 17

5. BUSINESS ACQUISITIONS

2015 Acquisitions

Acquisition of MemorialCare Health System's Laboratory Outreach Business

On August 3, 2015, the Company completed the acquisition of MemorialCare Health System's laboratory outreach

business ("MemorialCare") in an all-cash transaction valued at $35 million. The assets acquired primarily represent tax

deductible goodwill and intangible assets, principally comprised of customer-related intangibles.

Acquisition of the Business Assets of Superior Mobile Medics, Inc.

On November 16, 2015, the Company completed the acquisition of the business assets of Superior Mobile Medics,

Inc. ("Superior Mobile Medics"), a national provider of paramedical and health data collection services to the life insurance and

employer health and wellness industries, in an all-cash transaction valued at $27 million. The assets acquired primarily

represent accounts receivable, tax deductible goodwill and intangible assets, principally comprised of customer-related

intangibles.

2014 Acquisitions

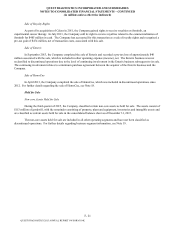

Acquisition of Solstas Lab Partners Group

On March 7, 2014, the Company completed its acquisition of Solstas Lab Partners Group and its subsidiaries

("Solstas") in an all-cash transaction valued at $572 million, or $563 million net of cash acquired. The Company financed the

acquisition with borrowings under its secured receivables credit facility and senior unsecured revolving credit facility. The final

consideration paid is subject to post closing adjustments related to working capital and other items. Through the acquisition,

the Company acquired all of Solstas' operations. Solstas is a full-service commercial laboratory based in Greensboro, North

Carolina and operates in nine states throughout the southeastern United States, including the Carolinas, Virginia, Tennessee,

Georgia and Alabama.

For the year ended December 31, 2014, Solstas contributed $300 million to the Company's consolidated net revenues

and $294 million to operating expenses which included approximately $17 million of restructuring, integration and transaction

related costs. Of the $17 million of restructuring, integration and transaction related costs recorded for the year ended

December 31, 2014, $4 million and $13 million were in cost of services and selling, general and administrative expenses,

respectively.

Acquisition of Summit Health, Inc.

On April 18, 2014, the Company completed its acquisition of Summit Health, Inc. ("Summit Health") for $152 million,

which consisted of cash consideration of $125 million (which included $10 million of working capital adjustments), or $124

million net of cash acquired, estimated contingent consideration of $22 million and $5 million associated with certain

transaction related costs due to the sellers of Summit Health. The contingent consideration arrangement was dependent on the

achievement of certain revenue targets in 2015, with a maximum payment of $25 million in 2016. Based on actual 2015

revenue results for Summit Health compared to the earn-out target included in the contingent consideration arrangement, no

payment is required, and therefore, the contingent consideration accrual was $0 at December 31, 2015. At December 31, 2014,

the contingent consideration accrual was $13 million. Through the acquisition, the Company acquired all of Summit Health's

operations. Summit is a provider of on-site prevention and wellness programs. For further details regarding the fair value of

the estimated contingent consideration associated with the Summit Health acquisition, see Note 7.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K