Quest Diagnostics 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 39

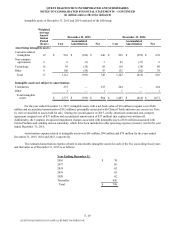

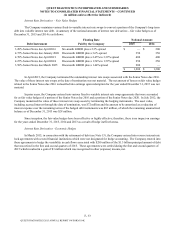

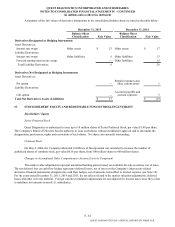

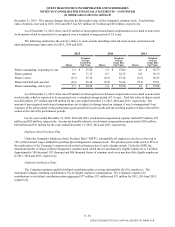

Supplemental Deferred Compensation Plans

The Company has a supplemental deferred compensation plan that is an unfunded, non-qualified plan that provides for

certain management and highly compensated employees to defer up to 50% of their salary in excess of their defined

contribution plan limits and for certain eligible employees, up to 95% of their variable incentive compensation. The maximum

Company matching contribution is 5% of eligible employee compensation. The compensation deferred under this plan,

together with Company matching amounts, are credited with earnings or losses measured by the mirrored rate of return on

investments elected by plan participants. Each plan participant is fully vested in all deferred compensation, Company match

and earnings credited to their account. The amounts accrued under the Company's deferred compensation plans were $49

million at both December 31, 2015 and 2014. Although the Company is currently contributing all participant deferrals and

matching amounts to trusts, the funds in these trusts, totaling $49 million at both December 31, 2015 and 2014, are general

assets of the Company and are subject to any claims of the Company's creditors.

The Company also offers certain employees the opportunity to participate in a non-qualified deferred compensation

program. Eligible participants are allowed to defer up to $20 thousand of eligible compensation per year. The Company

matches employee contributions equal to 25%, up to a maximum of $5 thousand per plan year. A participant's deferrals,

together with Company matching credits, are “invested” at the direction of the employee in a hypothetical portfolio of

investments which are tracked by an administrator. Each participant is fully vested in their deferred compensation and vests in

Company matching contributions over a four-year period at 25% per year. The amounts accrued under this plan were $36

million at both December 31, 2015 and 2014. The Company purchases life insurance policies, with the Company named as

beneficiary of the policies, for the purpose of funding the program's liability. The cash surrender value of such life insurance

policies was $29 million and $30 million at December 31, 2015 and 2014, respectively.

For the years ended December 31, 2015, 2014 and 2013, the Company's expense for matching contributions to these

plans were not material.

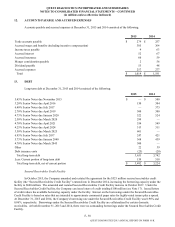

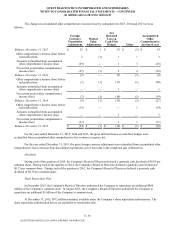

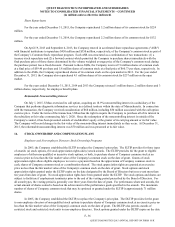

17. COMMITMENTS AND CONTINGENCIES

Letters of Credit and Contractual Obligations

The Company can issue letters of credit under its Secured Receivables Credit Facility and Senior Unsecured

Revolving Credit Facility (see Note 13). In support of its risk management program, to ensure the Company’s performance or

payment to third parties, $67 million in letters of credit, principally issued under the Secured Receivables Credit Facility, were

outstanding at December 31, 2015. The letters of credit primarily represent collateral for current and future automobile liability

and workers’ compensation loss payments.

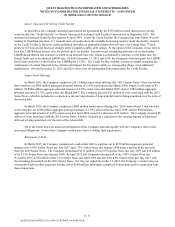

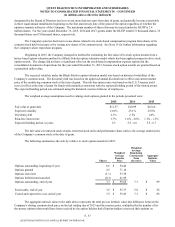

Minimum rental commitments under noncancelable operating leases, primarily real estate, in effect at December 31,

2015 are as follows:

Year Ending December 31,

2016 $ 182

2017 138

2018 94

2019 67

2020 44

2021 and thereafter 152

Minimum lease payments $ 677

Operating lease rental expense for 2015, 2014 and 2013 totaled $224 million, $242 million and $223 million,

respectively. Rent expense associated with operating leases that include scheduled rent increases and tenant incentives,

such as rent holidays and improvement allowances, is recorded on a straight-line basis over the term of the lease.

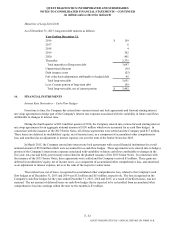

The Company has certain noncancelable commitments to purchase products or services from various suppliers,

mainly for consulting and other service agreements, and standing orders to purchase reagents and other laboratory supplies.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K