Quest Diagnostics 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

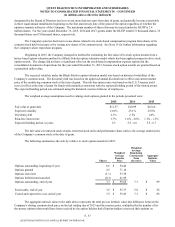

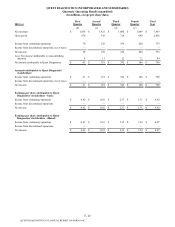

Quarterly Operating Results (unaudited)

(in millions, except per share data)

F- 47

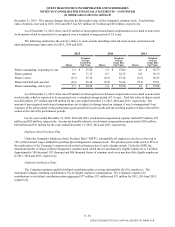

(income), net, representing non-cash asset impairment charges; and pre-tax charges of $65 million on retirement of debt

associated with the April 2015 redemption in other (expense) income, net (see Note 13).

(d) Includes a pre-tax gain of $334 million associated with the contribution of the Company's clinical trials testing business to

Q2 Solutions (see Note 6); and pre-tax charges of $29 million, primarily associated with workforce reductions and

professional fees incurred in connection with further restructuring and integrating the Company ($20 million in cost of

services and $9 million in selling, general and administrative expenses).

(e) Includes pre-tax charges of $22 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company ($12 million in cost of services and $10 million in

selling, general and administrative expenses); pre-tax charges of $11 million in other operating expense (income), net,

representing non-cash asset impairment charges associated with winding down a subsidiary; and pre-tax charges in selling,

general and administrative expenses of $10 million, principally representing costs incurred related to legal matters. Income

from continuing operations includes a deferred income tax benefit of $58 million associated with winding down a

subsidiary.

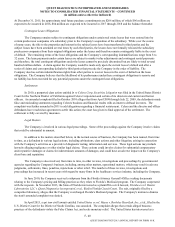

(f) Includes pre-tax charges of $24 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company ($12 million in cost of services and $12 million in

selling, general and administrative expenses); and pre-tax charges in selling, general and administrative expenses of $4

million, principally representing costs incurred related to legal matters.

(g) Includes pre-tax charges of $27 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company ($11 million in cost of services and $16 million in

selling, general and administrative expenses); and pre-tax charges in selling, general and administrative expenses of $7

million, principally representing costs incurred related to legal matters.

(h) Includes pre-tax charges of $40 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company ($14 million in cost of services, $25 million in selling,

general and administrative expenses and $1 million in other operating expense (income), net); and pre-tax charges in

selling, general and administrative expenses of $8 million, principally representing costs incurred related to legal matters.

(i) Includes pre-tax charges of $30 million, primarily associated with workforce reductions and professional fees incurred in

connection with further restructuring and integrating the Company ($13 million in cost of services, $16 million in selling,

general and administrative expenses and $1 million in other operating expense (income), net); pre-tax charges in selling,

general and administrative expenses of $5 million, principally representing costs incurred related to legal matters; and a

pre-tax gain included in other operating expense (income), net of $9 million associated with a decrease in the fair value of

the contingent consideration accrual associated with the Summit Health acquisition (see Note 5 and Note 7). Income from

continuing operations includes a discrete benefit of $44 million associated with the favorable resolution of certain tax

contingencies.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K