Quest Diagnostics 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

F- 27

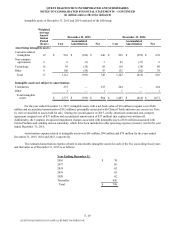

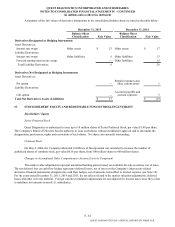

Accruals for interest expense on contingent tax liabilities are classified in income tax expense in the consolidated

statements of operations. Accruals for penalties have historically been immaterial. Interest expense (income) included in

income tax expense in each of the years ended December 31, 2015, 2014 and 2013 was approximately $0 million, $(1) million

and $3 million respectively. As of December 31, 2015 and 2014, the Company has approximately $9 million and $12 million,

respectively, accrued, net of the benefit of a federal and state deduction, for the payment of interest on uncertain tax positions.

The recognition and measurement of certain tax benefits includes estimates and judgment by management and

inherently involves subjectivity. Changes in estimates may create volatility in the Company's effective tax rate in future periods

and may be due to settlements with various tax authorities (either favorable or unfavorable), the expiration of the statute of

limitations on some tax positions and obtaining new information about particular tax positions that may cause management to

change its estimates.

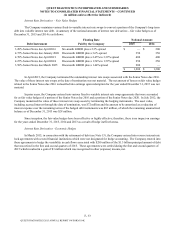

In the regular course of business, various federal, state, local and foreign tax authorities conduct examinations of the

Company's income tax filings and the Company generally remains subject to examination until the statute of limitations expires

for the respective jurisdiction. The Internal Revenue Service (“IRS”) has completed its examinations of the Company's

consolidated federal income tax returns up through and including the 2011 tax year; however, the Company plans to pursue all

alternatives for settlement, including litigation, for certain tax adjustments related to its 2009 tax year. At this time, the

Company does not believe that there will be any material additional payments beyond its recorded contingent liability reserves

that may be required as a result of these tax audits. As of December 31, 2015, a summary of the tax years that remain subject to

examination, or that are under appeal, for the Company's major jurisdictions are:

United States - federal 2012 - 2015

United States - various states 2006 - 2015

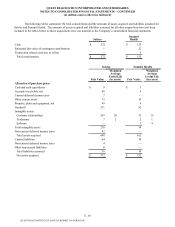

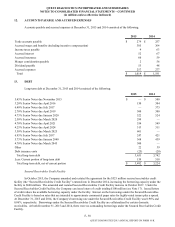

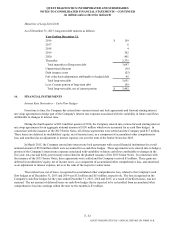

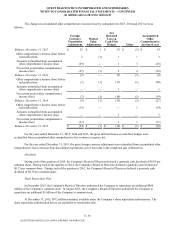

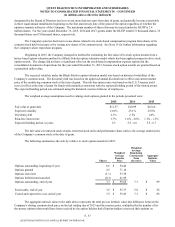

9. SUPPLEMENTAL CASH FLOW & OTHER DATA

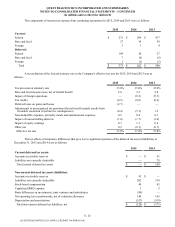

Supplemental cash flow data for the years ended December 31, 2015, 2014 and 2013 was as follows:

2015 2014 2013

Depreciation expense $ 223 $ 220 $ 204

Amortization expense 81 94 79

Depreciation and amortization expense $ 304 $ 314 $ 283

Interest paid $ 172 $ 170 $ 167

Income taxes paid 319 327 568

Assets acquired under capital leases 3 12 13

Accounts payable associated with capital expenditures 15 26 28

Dividend payable $ 55 $ 48 $ 43

Businesses acquired:

Fair value of assets acquired $ 63 $ 853 $ 280

Fair value of liabilities assumed — 85 16

Fair value of net assets acquired 63 768 264

Merger consideration paid (payable), net 4 (30)(50)

Cash paid for business acquisitions 67 738 214

Less: Cash acquired — 10 1

Business acquisitions, net of cash acquired $ 67 $ 728 $ 213

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K