Quest Diagnostics 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

things, the enterprises’ ability to raise additional capital or derive cash inflows from continuing operations or through liquidity

events such as initial public offerings, mergers or private sales.

Liquidity and Capital Resources

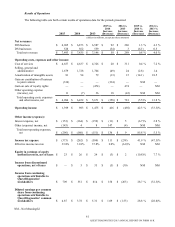

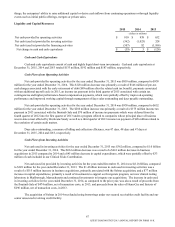

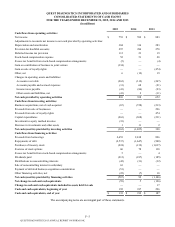

2015 2014 2013

(dollars in millions)

Net cash provided by operating activities $ 810 $ 938 $ 652

Net cash (used in) provided by investing activities (362)(1,025) 328

Net cash (used in) provided by financing activities (507) 92 (1,106)

Net change in cash and cash equivalents $ (59) $ 5 $ (126)

Cash and Cash Equivalents

Cash and cash equivalents consist of cash and highly liquid short-term investments. Cash and cash equivalents at

December 31, 2015, 2014 and 2013 totaled $133 million, $192 million and $187 million, respectively.

Cash Flows from Operating Activities

Net cash provided by operating activities for the year ended December 31, 2015 was $810 million, compared to $938

million for the year ended December 31, 2014. This $128 million decrease was primarily a result of $146 million of pre-tax

cash charges associated with the early retirement of debt ($89 million after the related cash tax benefit), payments associated

with an additional payroll cycle in 2015, an income tax payment in the third quarter of 2015 associated with certain tax

contingencies and higher performance-based compensation payments, which were partially offset by improved operating

performance and improved working capital through management of days sales outstanding and days payable outstanding.

Net cash provided by operating activities for the year ended December 31, 2014 was $938 million, compared to $652

million for the year ended December 31, 2013. The $286 million increase was primarily a result of a $175 million income tax

payment in 2013 associated with the Ibrutinib Sale and $70 million of income tax payments which were deferred from the

fourth quarter of 2012 into the first quarter of 2013 under a program offered to companies whose principal place of business

was in states most affected by Hurricane Sandy as well as a third quarter of 2013 income tax payment of $28 million related to

the resolution of certain audit matters.

Days sales outstanding, a measure of billing and collection efficiency, was 47 days, 48 days and 47 days at

December 31, 2015, 2014 and 2013, respectively.

Cash Flows from Investing Activities

Net cash used in investing activities for the year ended December 31, 2015 was $362 million, compared to $1.0 billion

for the year ended December 31, 2014. This $663 million decrease was a result of a $661 million decrease in business

acquisitions in 2015 compared to 2014 and a $45 million decrease in capital expenditures, which were partially offset by $33

million of cash included in our Clinical Trials Contribution.

Net cash (used in) provided by investing activities for the year ended December 31, 2014 was $(1.0) billion, compared

to $328 million for the year ended December 31, 2013. The $1.4 billion increase in cash used in investing activities was a

result of a $515 million increase in business acquisitions, primarily associated with the Solstas acquisition, and a $77 million

increase in capital expenditures, primarily a result of investments to support our Invigorate program, our new clinical testing

laboratory in Marlborough, Massachusetts and continued investments to integrate our acquisitions. The increase in cash used

in investing activities for the year ended December 31, 2014, as compared to the prior year, was also a result of proceeds from

the Ibrutinib Sale of $474 million, net of transaction costs, in 2013, and proceeds from the sales of HemoCue and Enterix of

$296 million, net of transaction costs, in 2013.

The acquisition of Solstas in 2014 was funded using borrowings under our secured receivables credit facility and our

senior unsecured revolving credit facility.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K