Pizza Hut 2000 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

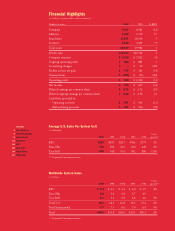

TRICON GLOBAL RESTAURANTS 5

return on invested capital improving to

18%, which we believe leads the industry and

is up 10 percentage points from 1997. In 2000,

we invested in 370 new company restaurants,

upgraded and remodeled 289 company restau-

rants, handled the AmeriServe problem and

purchased over $200 million of our shares.

We are confident we will continue to drive high

returns going forward.

Stepping back, we are a significantly stronger

company now than we were when we were spun

off by PepsiCo three years ago. We’ve more than

doubled ongoing operating earnings per share,

reduced debt by $2.2 billion, improved restau-

rant margins over 3 full points, reduced our

general and administrative expenses over $50 million,

improved ongoing operating

profit 32% and grown system

sales 8%, while closing almost

3,000 stores systemwide that

did not generate adequate

returns and reflect the proper

image for our brands.

As a result of Tricon’s strong

cash flow and financial condi-

tion, our Board of Directors has

authorized a share repurchase

program of up to an additional

$300 million to be executed

over the next two years. This is obviously a reflection of the

confidence the Board has in our outlook for 2001 and beyond.

Just as important, we’re confident we have put the building

blocks in place to drive consistent performance. There

is no doubt in our minds that Tricon has all the characteristics

to become one of the world’s great companies over time:

leading brands, a proven international business, tremendous

Return on Invested Capital

97 0098 99

18%

17%

12%

8%

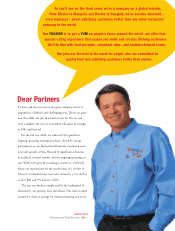

David C. Novak

Chairman and Chief Executive Officer

cash flow for reinvestment and the leaders around the world

to make it happen. We are targeting to consistently deliver

2% to 3% U.S. blended same store sales growth, open more

than 1,300 new worldwide restaurants each year, continue

to improve our industry competitive margins and deliver

mid-teens ongoing operating earnings per share growth.

As you read further, you’ll learn more about the exciting

plans at each of our companies from their presidents and

you’ll see how passionate our people are to become Customer

Maniacs. We know that by building the capability of our

people, customer mania will result and the profitability

that will make Tricon a great investment will follow. I’d like

to thank the over 725,000 people across the Tricon system,

our investors, franchise partners and outstanding Board of

Directors for their dedication and inspired ideas.

System Sales +8%

In billions

97 00

Restaurant

Margin +3.5ppts.

In percentage points

97 00

Co. Ownership 14%

In percent

97 00

G&A Expense

Declined 8%

In millions

97 00

Franchise Fees +36%

In millions

97 00

Ongoing Operating

Profit +32%

In millions

97 00

Debt Reduction 2.2bn

In billions

97 00

Ongoing Operating

EPS +110%

In dollars

97 00

Tricon has made solid financial progress since spin-off

Better (worse)

22.2

20.5

15.1

11.6

20%

34%

879

956

788

578

888

672

2.5

4.7

2.98

1.42