Pizza Hut 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

We have available net operating loss and tax credit carry-

forwards totaling $856 million at December 30, 2000 to

reduce future tax of TRICON and certain subsidiaries. The

carryforwards are related to a number of foreign and state

jurisdictions. Of these carryforwards, $13 million expire in

2001 and $760 million expire at various times between 2002

and 2020. The remaining $83 million of carryforwards do

not expire.

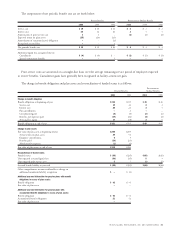

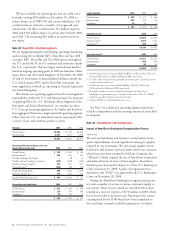

Note 20 Reportable Operating Segments

We are engaged principally in developing, operating, franchising

and licensing the worldwide KFC, Pizza Hut and Taco Bell

concepts. KFC, Pizza Hut and Taco Bell operate throughout

the U.S. and in 84, 87 and 13 countries and territories outside

the U.S., respectively. Our five largest international markets

based on ongoing operating profit in 2000 are Australia, China,

Japan, Korea and the United Kingdom. At December 30, 2000,

we had 10 investments in unconsolidated affiliates outside the

U.S. which operate KFC and/or Pizza Hut restaurants, the

most significant of which are operating in Canada, Japan and

the United Kingdom.

We identify our operating segments based on management

responsibility within the U.S. and International. For purposes

of applying SFAS No. 131 “Disclosure About Segments of An

Enterprise and Related Information” we consider our three

U.S. Concept operating segments to be similar and therefore

have aggregated them into a single reportable operating segment.

Other than the U.S., no individual country represented 10%

or more of our total revenues, profits or assets.

Revenues 2000 1999 1998

United States $5,062 $5,748 $6,439

International 2,031 2,074 2,040

$7,093 $7,822 $8,479

Operating Profit; Interest Expense, Net; and

Income Before Income Taxes 2000 1999 1998

United States $÷«742 $÷«828 $÷«740

International(a) 309 265 191

Foreign exchange (loss) gain –(3) 6

Unallocated and corporate expenses (163) (180) (169)

Facility actions net gain (b) 176 381 275

Unusual items(b) (204) (51) (15)

Total Operating Profit 860 1,240 1,028

Interest expense, net 176 202 272

Income before income taxes $÷«684 $1,038 $÷«756

Depreciation and Amortization 2000 1999 1998

United States $÷«231 $÷«266 $÷«300

International 110 110 104

Corporate 13 10 13

$÷«354 $÷«386 $÷«417

Capital Spending 2000 1999 1998

United States $÷«370 $÷«315 $÷« 305

International 192 139 150

Corporate 10 16 5

$÷«572 $÷«470 $÷«460

Identifiable Assets 2000 1999

United States $2,400 $2,444

International(c) 1,501 1,367

Corporate (d) 248 150

$4,149 $3,961

Long-Lived Assets(e) 2000 1999

United States $2,101 $2,143

International 828 874

Corporate 30 41

$2,959 $3,058

(a) Includes equity income of unconsolidated affiliates of $25 million, $22 mil-

lion and $18 million in 2000, 1999 and 1998, respectively.

(b) See Note 5 for a discussion by reportable operating segment of facility actions

net gain and unusual items.

(c) Includes investment in unconsolidated affiliates of $257 million and

$170 million for 2000 and 1999, respectively.

(d) Primarily includes accounts receivable arising from the AmeriServe

bankruptcy reorganization process as further discussed in Note 21, PP&E

related to our office facilities and restricted cash.

(e) Includes PP&E, net and Intangible Assets, net.

See Note 5 for additional operating segment disclosures

related to impairment and the carrying amount of assets held

for disposal.

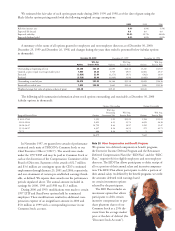

Note 21 Commitments and Contingencies

Impact of AmeriServe Bankruptcy Reorganization Process

Overview

We and our franchisees and licensees are dependent on fre-

quent replenishment of food ingredients and paper supplies

required by our restaurants. We and a large number of our

franchisees and licensees operated under multi-year contracts,

which have now been assumed by McLane Company, Inc.

(“McLane”), which required the use of AmeriServe to purchase

and make deliveries of most of these supplies. AmeriServe

filed for protection under Chapter 11 of the U.S. Bankruptcy

Code on January 31, 2000. A plan of reorganization for

AmeriServe (the “POR”) was approved by the U.S. Bankruptcy

Court on November 28, 2000.

During the AmeriServe bankruptcy reorganization process,

we took a number of actions to ensure continued supply to

our system. These actions, which are described below, have

resulted in a total net expense of $170 million in 2000, which

has been recorded as unusual items. Based upon the actions

contemplated by the POR which have been completed to

date and other currently available information, we believe