Pizza Hut 2000 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

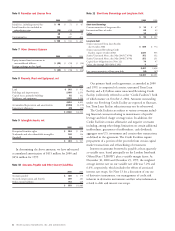

Note 4 Earnings Per Common Share (“EPS”)

2000 1999 1998

Net income $«413 $«627 $«445

Basic EPS:

Weighted-average common

shares outstanding 147 153 153

Basic EPS $2.81 $4.09 $2.92

Diluted EPS:

Weighted-average common

shares outstanding 147 153 153

Shares assumed issued on exercise

of dilutive share equivalents 19 24 20

Shares assumed purchased with

proceeds of dilutive share equivalents (17) (17) (17)

Shares applicable to diluted earnings 149 160 156

Diluted EPS $2.77 $3.92 $2.84

Unexercised employee stock options to purchase approxi-

mately 10.8 million, 2.5 million and 1.0 million shares of

our Common Stock for the years ended December 30, 2000,

December 25, 1999 and December 26, 1998, respectively,

were not included in the computation of diluted EPS because

their exercise prices were greater than the average market

price of our Common Stock during the year.

Note 5 Items Affecting Comparability of Net Income

Accounting Changes

In 1998 and 1999, we adopted several accounting and

human resource policy changes (collectively, the “accounting

changes”) that impacted our 1999 operating profit. These

changes, which we believe are material in the aggregate, fall

into three categories:

• required changes in accounting principles generally accepted

in the U.S. (“GAAP”),

• discretionary methodology changes implemented to more

accurately measure certain liabilities and

• policy changes driven by our human resource and account-

ing standardization programs.

Required Changes in GAAP

Effective December 27, 1998, we adopted Statement of Position

98-1 (“SOP 98-1”), “Accounting for the Costs of Computer

Software Developed or Obtained for Internal Use.” SOP 98-1

identifies the characteristics of internal-use software and specifies

that once the preliminary project stage is complete, direct exter-

nal costs, certain direct internal payroll and payroll-related costs

and interest costs incurred during the development of computer

software for internal use should be capitalized and amortized.

Previously, we expensed all software development and procure-

ment costs as incurred. In 1999, we capitalized approximately

$13 million of internal software development costs and third

party software costs that we would have previously expensed.

The amortization of computer software assets that became

ready for their intended use in 1999 was insignificant.

In addition, we adopted Emerging Issues Task Force Issue

No. 97-11 (“EITF 97-11”), “Accounting for Internal Costs

Relating to Real Estate Property Acquisitions,” upon its

issuance in March 1998. EITF 97-11 limits the capitalization

of internal real estate acquisition costs to those site-specific

costs incurred subsequent to the time that the real estate

acquisition is probable. We consider acquisition of the prop-

erty probable upon final site approval. In the first quarter of

1999, we also made a discretionary policy change limiting the

types of costs eligible for capitalization to those direct cost

types described as capitalizable under SOP 98-1. Prior to the

adoption of EITF 97-11, all pre-acquisition real estate activities

were considered capitalizable. This change unfavorably impacted

our 1999 operating profit by approximately $3 million.

To conform to the Securities and Exchange Commission’s

April 23, 1998 interpretation of SFAS No. 121, “Accounting

for the Impairment of Long-Lived Assets and for Long-Lived

Assets to Be Disposed Of,” our store closure accounting policy

was changed in 1998. Effective for closure decisions made

on or subsequent to April 23, 1998, we recognize store closure

costs when we have closed the restaurant within the same

quarter the closure decision is made. When we decide to close

a restaurant beyond the quarter in which the closure decision

is made, it is reviewed for impairment. The impairment eval-

uation is based on the estimated cash flows from continuing

use until the expected date of disposal plus the expected

terminal value. If the restaurant is not fully impaired, we

continue to depreciate the assets over their estimated remain-

ing useful life. Prior to April 23, 1998, we recognized store

closure costs and generally suspended depreciation and amor-

tization when we decided to close a restaurant within the

next twelve months. In fiscal year 1999, this change resulted

in additional depreciation and amortization of approximately

$3 million through April 23, 1999.

Discretionary Methodology Changes

In 1999, the methodology used by our independent actuary

was refined and enhanced to provide a more reliable estimate

of the self-insured portion of our current and prior years’

ultimate loss projections related to workers’ compensation,

general liability and automobile liability insurance programs

(collectively “casualty loss(es)”). Our prior practice was to apply

a fixed factor to increase our independent actuary’s ultimate

loss projections which was at the 51% confidence level for

each year to approximate our targeted 75% confidence level.