Pizza Hut 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 33

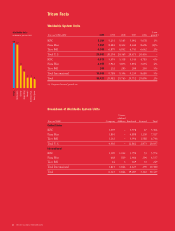

U.S. System Sales

System sales were essentially flat in 2000. Excluding the

favorable impact of the fifty-third week in 2000, system sales

decreased 2%. The decrease was due to same stores sales

declines at Taco Bell and KFC as well as store closures, par-

tially offset by new unit development.

In 1999, system sales increased $503 million or 4%. The

improvement was driven by new unit development and same

store sales growth. These increases were partially offset by

store closures.

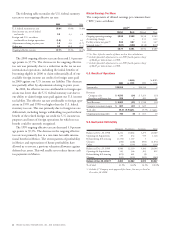

U.S. Revenues

Company sales decreased $720 million or 14%. As expected,

the decline in Company sales was due to the Portfolio Effect

partially offset by the favorable impact from the fifty-third week

in 2000. Excluding these items, Company sales increased 1%

in 2000. This increase was primarily due to new unit devel-

opment and favorable Effective Net Pricing almost fully

offset by volume declines.

In 2000, U.S. blended Company same store sales for our

three Concepts decreased 2%. The decline in transactions of

4% was partially offset by favorable Effective Net Pricing of

2%. Same store sales at Pizza Hut increased 1%. Favorable

Effective Net Pricing of 3% was partially offset by transaction

declines of 2%. Same store sales at KFC decreased 3%, primar-

ily due to transaction declines. Same store sales at Taco Bell

decreased 5% as a result of transaction declines.

Franchise and license fees grew $34 million or 7% in 2000.

Excluding the favorable impact from the fifty-third week in

2000, franchise and license fees increased 5%. The increase

was driven by units acquired from us and new unit develop-

ment, partially offset by franchisee same store sales declines

and store closures.

In 1999, Company sales declined $760 million or 13%.

As expected, the decline in Company sales was due to the

Portfolio Effect. Excluding the Portfolio Effect, Company sales

increased 6%. This increase was primarily due to new unit

development, favorable Effective Net Pricing and volume

increases led by the launch of “The Big New Yorker” pizza.

In 1999, U.S. blended same stores sales for our three

Concepts increased 4%. Favorable Effective Net Pricing of

5% was partially offset by a 1% decline in transactions. Same

store sales at Pizza Hut increased 9% in 1999. The improve-

ment was primarily driven by an increase in transactions of

over 5%, resulting from the launch of “The Big New Yorker.”

The growth at Pizza Hut was also aided by Effective Net

Pricing of over 3%. Same store sales at KFC grew 2%. The

increase was almost equally driven by Effective Net Pricing

and transaction growth. Same store sales at Taco Bell were

flat as an increase in Effective Net Pricing of approximately

4% was fully offset by transaction declines.

Franchise and license fees increased $69 million or 16%

in 1999. The increase was driven by units acquired from us,

new unit development and franchisee same store sales growth,

primarily at Pizza Hut. These increases were partially offset

by store closures.

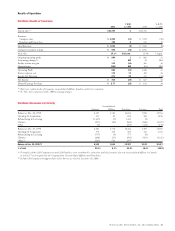

U.S. Company Restaurant Margin

2000 1999 1998

Company sales 100.0% 100.0% 100.0%

Food and paper 28.6 30.0 31.0

Payroll and employee benefits 30.8 29.8 30.4

Occupancy and other operating expenses 25.4 24.5 25.0

Restaurant margin 15.2% 15.7% 13.6%

Restaurant margin as a percentage of sales decreased

approximately 55 basis points in 2000, including the unfavor-

able impact of nearly 25 basis points from lapping the 1999

accounting changes. Restaurant margin included 70 basis

points related to the favorable impact of the Portfolio Effect.

Excluding these items, our base restaurant margin declined

approximately 100 basis points. This decrease included approx-

imately 60 basis points resulting from the absence of favorable

1999 insurance-related adjustments of $30 million, which are

more fully discussed in Note 21. The remaining decrease was

due to a shift to lower margin chicken sandwiches at KFC

and volume declines at Taco Bell, partially offset by Effective

Net Pricing. Favorable commodity costs, primarily cheese,

were almost fully offset by higher occupancy and other costs

as well as increased wage rates.

In 1999, our restaurant margin as a percentage of sales

increased approximately 210 basis points. The Portfolio Effect

contributed approximately 45 basis points and accounting

changes contributed nearly 25 basis points to the improve-

ment. Excluding these items, our base restaurant margin grew

approximately 140 basis points. The increase was primarily