Pizza Hut 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

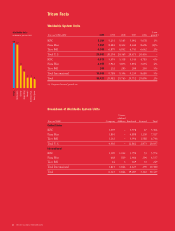

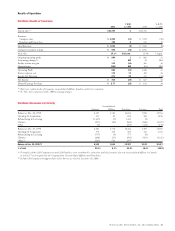

Worldwide System Sales

System sales increased $397 million or 2% in 2000, after a 1%

unfavorable impact from foreign currency translation. Exclud-

ing the negative impact of foreign currency translation and the

favorable impact of the fifty-third week, system sales increased

1%. This increase was driven by new unit development, par-

tially offset by store closures and same store sales declines.

In 1999, system sales increased $1.1 billion or 6%. The

improvement was driven by new unit development and same

store sales growth. U.S. development was primarily at Taco

Bell while International development was primarily in Asia.

The increase was partially offset by store closures.

Worldwide Revenues

Company sales decreased $794 million or 11% in 2000. As

expected, the decline in Company sales was primarily due to

the Portfolio Effect partially offset by the favorable impact

from the fifty-third week in 2000. Excluding these items,

Company sales increased 4%. This increase was primarily

due to new unit development and favorable Effective Net

Pricing, partially offset by volume declines. Effective Net

Pricing includes increases or decreases in price and the effect

of changes in product mix.

Franchise and license fees increased approximately $65 mil-

lion or 9% in 2000. The increase was driven by units acquired

from us and new unit development, partially offset by store

closures and franchisee same store sales declines in the U.S.

The negative impact of foreign currency translation was

essentially offset by the favorable impact from the fifty-third

week in 2000.

Company sales decreased $753 million or 10% in 1999.

As expected, the decline in Company sales was due to the

Portfolio Effect. Excluding the Portfolio Effect, Company sales

increased 8%. The increase was primarily due to new unit

development, favorable Effective Net Pricing and volume

increases in the U.S. and International. The volume increase in

the U.S. was led by the launch of “The Big New Yorker” pizza.

Franchise and license fees grew $96 million or 15% in

1999. The growth was primarily driven by units acquired from

us and new unit development, primarily in Asia and at Taco

Bell in the U.S., partially offset by store closures by franchisees

and licensees.

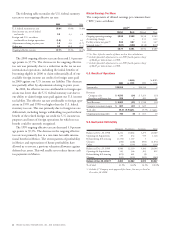

Worldwide Company Restaurant Margin

2000 1999 1998

Company sales 100.0% 100.0% 100.0%

Food and paper 30.8 31.5 32.1

Payroll and employee benefits 27.7 27.6 28.6

Occupancy and other operating expenses 26.4 25.5 25.8

Restaurant margin 15.1% 15.4% 13.5%

Restaurant margin as a percentage of sales decreased

approximately 25 basis points in 2000, including the unfa-

vorable impact of 15 basis points from lapping the 1999

accounting changes. Restaurant margin included 70 basis

points related to the favorable impact of the Portfolio Effect.

Excluding the net effect of these items, our base restaurant

margin declined approximately 80 basis points. Approximately

40 basis points of this decrease resulted from the favorable

1999 U.S. insurance-related adjustments of $30 million,

which are more fully discussed in Note 21. The remaining

decrease was primarily due to a decline in U.S. restaurant

margin, as discussed in the U.S. Restaurant Margin section.

In 1999, our restaurant margin as a percentage of sales

increased approximately 190 basis points. The Portfolio Effect

contributed nearly 50 basis points and accounting changes

contributed approximately 15 basis points to our improve-

ment. Excluding these items, our base restaurant margin

increased approximately 125 basis points. This improvement

was primarily attributable to Effective Net Pricing in excess

of cost increases (primarily higher wage rates) in the U.S.

Restaurant margin also benefited from improved food and

paper cost management in both the U.S. and certain key

International equity markets. Volume increases at Pizza Hut

in the U.S. and in certain key International equity markets

were fully offset by volume declines at Taco Bell and the

unfavorable impact of the introduction of lower margin

chicken sandwiches at KFC in the U.S.

Worldwide General & Administrative Expenses

G&A declined $41 million or 4% in 2000. Excluding the

benefit from lapping the 1999 accounting changes, ongoing

G&A decreased $59 million or 6%. The decrease was primar-

ily due to lower incentive compensation expense and Year

2000 costs as well as the favorable impact of the Portfolio

Effect. Reduced spending on conferences also contributed

to the decline. The decrease was partially offset by higher

franchise-related expenses, primarily allowances for doubtful

franchise and license fee receivables, as more fully discussed

in the Franchisee Financial Condition section. G&A included

Year 2000 spending of approximately $2 million in 2000 as

compared to approximately $30 million in 1999.

In 1999, G&A decreased $21 million or 2%. Excluding

the $18 million favorable impact of the 1999 accounting

changes, G&A decreased $3 million. The favorable impacts

of the Portfolio Effect, our fourth quarter 1998 decision to

streamline our international business and the absence of costs

associated with relocating certain operations from Wichita,

Kansas in 1998 were partially offset by higher strategic and

other corporate expenses. In addition, higher spending on

conferences and the absence of favorable cost recovery agree-

ments with AmeriServe and PepsiCo also partially offset the

decreases discussed above.