Pizza Hut 2000 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 51

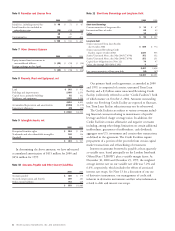

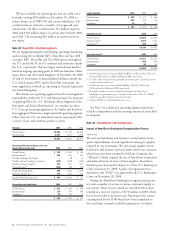

The following table summarizes the 2000 and 1999 activity

related to all stores disposed of or held for disposal including

the stores that were covered by the fourth quarter 1997 charge.

We believe that the remaining carrying amounts are adequate

to complete our disposal actions.

Asset

Impairment

Allowances Liabilities

Carrying amount at December 26, 1998 $«127 $«77

Amounts used (100) (36)

(Income) expense impact:

New decisions 915

Estimate/decision changes (20) 15

Other 4–

Carrying amount at December 25, 1999 $«÷20 $«÷71

Amounts used (10) (22)

(Income) expense impact:

New decisions 14 5

Estimate/decision changes (4) (7)

Other –3

Carrying amount at December 30, 2000 $«÷20 $«÷50

The carrying values of assets held for disposal, which

were all located in the U.S., were $2 million and $40 million

at December 30, 2000 and December 25, 1999, respectively.

These assets included restaurants and in 1999, our idle pro-

cessing facility in Wichita, Kansas, which was sold in 2000

for its approximate net book value.

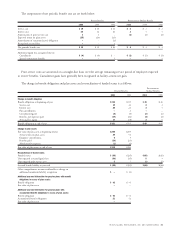

The following table summarizes Company sales and restau-

rant margin related to stores held for disposal at December 30,

2000 or disposed of through refranchising or closure during

2000, 1999 and 1998. Restaurant margin represents Company

sales less the cost of food and paper, payroll and employee

benefits and occupancy and other operating expenses. These

amounts do not include the impact of Company stores that

have been or are expected to be contributed to new uncon-

solidated affiliates.

2000 1999 1998

Stores held for disposal or disposed of in 2000:

Sales $408 $750 $690

Restaurant margin 55 97 92

Stores disposed of in 1999 and 1998:

Sales $659 $1,825

Restaurant margin 66 192

The margin reported above reflects a benefit from the sus-

pension of depreciation and amortization of approximately

$2 million, $9 million and $32 million in 2000, 1999 and

1998, respectively. The loss of restaurant margin from the

disposal of these stores was largely mitigated by (a) increased

franchise fees from stores refranchised; (b) lower field general

and administrative expenses; and (c) the estimated interest

savings from the reduction of average debt with net after-tax

refranchising proceeds.

Unusual Items

2000 1999 1998

U.S. $÷29 $13 $12

International 834

Unallocated 167 35 (1)

Worldwide $204 $51 $15

After-tax $129 $29 $÷3

Unusual items in 2000 included: (a) $170 million of

charges and direct incremental costs related to the AmeriServe

Food Distribution, Inc. (“AmeriServe”) bankruptcy reorgani-

zation process; (b) an increase in the estimated costs of

settlement of certain wage and hour litigation and associated

defense costs incurred in 2000; (c) costs associated with the

formation of an unconsolidated affiliate in Canada; and

(d) the reversal of excess provisions arising from the resolu-

tion of a dispute associated with the disposition of our

Non-core Businesses. See Note 21 for further discussion of

the AmeriServe bankruptcy reorganization process and wage

and hour litigation.

Unusual items in 1999 included: (a) the write-off of

approximately $41 million owed to us by AmeriServe at the

AmeriServe bankruptcy petition date; (b) an increase in the

estimated costs of settlement of certain wage and hour litiga-

tion and associated defense and other costs incurred in 1999;

(c) favorable adjustments to our 1997 fourth quarter charge;

(d) the write-down to estimated fair market value less cost to

sell of our idle Wichita processing facility; (e) costs associated

with the formation of unconsolidated affiliates in Canada

and Poland; (f) the impairment of enterprise-level goodwill

in one of our international businesses; and (g) severance and

other exit costs related to strategic decisions to streamline

the infrastructure of our international business.

Unusual items in 1998 included: (a) an increase in the

estimated costs of settlement of certain wage and hour litiga-

tion and associated defense and other costs incurred in 1998;

(b) severance and other exit costs related to strategic decisions

to streamline the infrastructure of our international businesses;

(c) favorable adjustments to our 1997 fourth quarter charge

related to anticipated actions that were not taken, primarily

severance; (d) the writedown to estimated fair market value

less costs to sell our minority interest in a privately held Non-

core Business, previously carried at cost; and (e) reversals of

certain impairment allowances and lease liabilities relating to

better-than-expected proceeds from the sale of properties and

settlement of lease liabilities associated with properties retained

upon the sale of a Non-core Business.