Pizza Hut 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 35

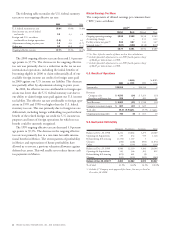

International System Sales

System sales increased $399 million or 6% in 2000, after

a 2% unfavorable impact from foreign currency translation.

Excluding the negative impact of foreign currency translation

and the favorable impact of the fifty-third week in 2000, sys-

tem sales increased 7%. This increase was driven by new unit

development, led by China, Korea and Japan and same store

sales growth. The increase was partially offset by store closures.

In 1999, system sales increased $639 million or 10%,

including a 2% favorable impact from foreign currency trans-

lation. This increase was largely driven by strong performance

in Asia, where system sales increased $426 million or 19%,

including a 10% favorable impact of foreign currency transla-

tion. In 1999, the economy in Asia began to show signs of a

steady recovery after the overall economic turmoil and weak-

ening of local currencies against the U.S. dollar that began in

late 1997. The increase in system sales in Asia was driven by

new unit development and same store sales growth. Outside

of Asia, the improvement was driven by new unit development

and same store sales growth. The increases were partially off-

set by store closures primarily by franchisees in Canada,

Latin America and Japan.

International Revenues

Company sales decreased $74 million or 4% in 2000, after

a 3% unfavorable impact from foreign currency translation.

As expected, the decline in Company sales was primarily due

to the Portfolio Effect partially offset by the favorable impact

from the fifty-third week in 2000. Excluding all three of

these items, Company sales increased 11% primarily due to

new unit development and favorable Effective Net Pricing.

Franchise and license fees increased approximately $31 mil-

lion or 14% in 2000, after a 3% unfavorable impact from

foreign currency translation. Excluding the negative impact of

foreign currency translation and the favorable impact from the

fifty-third week in 2000, franchise and license fees increased

16%. The increase was driven by new unit development, units

acquired from us and franchisee same store sales growth. These

increases were partially offset by store closures.

Company sales increased less than 1% in 1999. Excluding

the Portfolio Effect, Company sales increased 13% largely

driven by the strong performance in Asia. The increase was

primarily due to new unit development, favorable Effective

Net Pricing and volume increases.

Franchise and license fees rose $27 million or 13% in 1999.

The increase in franchise and license fees was driven by new

unit development, franchisee same store sales growth and

units acquired from us. New unit development was primarily

in Asia. These increases were partially offset by store closures.

International Company Restaurant Margin

2000 1999 1998

Company sales 100.0% 100.0% 100.0%

Food and paper 36.5 36.0 35.8

Payroll and employee benefits 19.5 21.0 22.6

Occupancy and other operating expenses 28.9 28.6 28.6

Restaurant margin 15.1% 14.4% 13.0%

Restaurant margin as a percentage of sales increased approx-

imately 65 basis points in 2000. Excluding the Portfolio Effect

of approximately 70 basis points, base restaurant margin was

essentially flat.

Restaurant margin as a percentage of sales increased approx-

imately 140 basis points in 1999. Excluding the favorable

impact of foreign currency translation, restaurant margin

increased approximately 130 basis points. Portfolio Effect

contributed approximately 50 basis points. Excluding these

items, our base restaurant margin grew approximately 80 basis

points. The improvement was driven by volume increases in

China, Korea and Australia and favorable Effective Net Pricing

in excess of cost increases, primarily in the United Kingdom,

Puerto Rico and Korea. Our growth in 1999 was partially

offset by volume decreases in Taiwan and Poland. In addition

to the factors described above, restaurant margin benefited

from improved cost management, primarily in China.

International Ongoing Operating Profit

Ongoing operating profit grew $44 million or 16% in 2000,

after a 2% unfavorable impact from foreign currency trans-

lation. Excluding the negative impacts of the Portfolio Effect

and foreign currency translation and the favorable impact

from the fifty-third week in 2000, ongoing operating profit

grew 19%. Higher franchise and license fees and Company

new unit development drove the increase.

In 1999, ongoing operating profit grew $74 million or

39%, including a 3% favorable impact from foreign currency

translation. The increase in operating profit was driven by our

base margin improvement of approximately 80 basis points,

higher franchise and license fees and a decline in G&A.

Ongoing operating profit benefited from the economic recov-

ery in Asia. Operating profit in Asia increased $55 million or

84%, including a 12% favorable impact from foreign currency

translation. Additionally, ongoing operating profit included

benefits of approximately $15 million principally from our

1998 fourth quarter decision to streamline our international

infrastructure in Asia, Europe and Latin America.