Pizza Hut 2000 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

If interest rates remain within the collared cap and floor, no

payments are made. If rates rise above the cap level, we receive

a payment. If rates fall below the floor level, we make a pay-

ment. At December 30, 2000 and December 25, 1999, we

did not have any outstanding interest rate collars.

We enter into foreign currency exchange contracts with the

objective of reducing our exposure to earnings and cash flow

volatility associated with foreign currency fluctuations. In

2000 and 1999, we entered into forward contracts to hedge

our exposure related to certain foreign currency receivables

and payables. The notional amount and maturity dates of

these contracts match those of the underlying receivables or

payables. Accordingly, any change in market value associated

with the forward contracts is offset by the opposite market

impact on the related receivables or payables. At December 30,

2000 and December 25, 1999, we had outstanding forward

contracts related to certain foreign currency receivables and

payables with notional amounts of $13 million and $9 million,

respectively. Our net receivable under the related forward

agreements, all of which terminate in 2001, was insignificant

at December 30, 2000 and December 25, 1999.

In 2000, we entered into forward contracts to reduce our

exposure to cash flow volatility associated with certain fore-

casted foreign currency denominated royalties. These forward

contracts are short-term in nature, with termination dates

matching royalty payments forecasted to be received within the

next twelve months. At December 30, 2000, we had outstand-

ing forward contracts associated with forecasted royalty cash

flows with notional amounts of $3 million. Our net receivable

for these contracts as of December 30, 2000 was insignificant.

Our credit risk from the interest rate swap, collar and

forward rate agreements and foreign exchange contracts is

dependent both on the movement in interest and currency

rates and possibility of non-payment by counterparties. We

mitigate credit risk by entering into these agreements with

high-quality counterparties, netting swap and forward rate

payments within contracts and limiting payments associated

with the collars to differences outside the collared range.

Open commodity future and option contracts and

deferred gains and losses at year-end 2000 and 1999, as well

as gains and losses recognized as part of cost of sales in 2000,

1999 and 1998, were not significant.

Concentrations of Credit Risk

Accounts receivable consists primarily of amounts due from

franchisees and licensees. Concentrations of credit risk with

respect to accounts receivable generally are limited due to a

large number of franchisees and licensees. At December 30,

2000, accounts receivable included amounts due from fran-

chisees related to the temporary direct purchase program,

which is more fully described in Note 21.

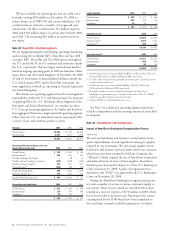

Fair Value

Excluding the financial instruments included in the table below,

the carrying amounts of our other financial instruments

approximate fair value.

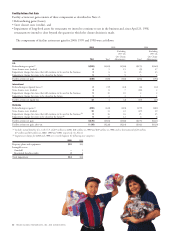

The carrying amounts and fair values of TRICON’s finan-

cial instruments are as follows:

2000 1999

Carrying Fair Carrying Fair

Amount Value Amount Value

Debt

Short-term borrowings

and long-term debt,

excluding capital leases $2,413 $2,393 $2,411 $2,377

Debt-related derivative

instruments

Open contracts in an

asset position – (24) –(3)

Debt, excluding

capital leases $2,413 $2,369 $2,411 $2,374

Guarantees and letters

of credit $÷÷÷«– $÷÷«51 $÷÷÷«– $÷÷«27

We estimated the fair value of debt, debt-related derivative

instruments, guarantees and letters of credit using market

quotes and calculations based on market rates. See Note 2

for recently issued accounting pronouncements relating to

derivative financial instruments.

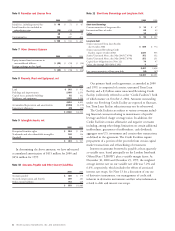

Note 14 Pension Plans and Postretirement Medical Benefits

Pension Benefits

We sponsor noncontributory defined benefit pension plans

covering substantially all full-time U.S. salaried employees,

certain hourly employees and certain international employ-

ees. Benefits are based on years of service and earnings or

stated amounts for each year of service.

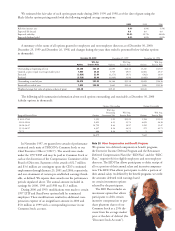

Postretirement Medical Benefits

Our postretirement plans provide health care benefits,

principally to U.S. retirees and

their dependents. These plans

include retiree cost sharing provi-

sions. Employees are eligible for

benefits if they meet age and

service requirements and qualify

for retirement benefits.