Pizza Hut 2000 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 30, 2000, we had unused borrowings avail-

able under the Revolving Credit Facility of approximately

$1.8 billion, net of outstanding letters of credit of $190 mil-

lion. Under the terms of the Revolving Credit Facility, we

may borrow up to $3.0 billion less outstanding letters of

credit. We pay a facility fee on the Revolving Credit Facility.

The facility fee rate and the aforementioned variable margin

factor are determined based on the more favorable of our

leverage ratio or third-party senior debt ratings as defined

in the agreement.

In 1997, we filed a shelf registration statement with the

Securities and Exchange Commission with respect to offerings

of up to $2 billion of senior unsecured debt. In May 1998, we

issued $350 million 7.45% Unsecured Notes due May 15,

2005 and $250 million 7.65% Unsecured Notes due May 15,

2008 (collectively referred to as the “Notes”). Interest com-

menced on November 15, 1998 and is payable semi-annually

thereafter. The effective interest rate on the 2005 Notes and

the 2008 Notes is 7.6% and 7.8%, respectively.

Interest expense on the short-term borrowings and long-

term debt was $190 million, $218 million and $291 million

in 2000, 1999 and 1998, respectively. As more fully discussed

in Note 21, interest expense of $9 million on incremental

borrowings related to the AmeriServe bankruptcy reorganiza-

tion process has been included in unusual items.

The annual maturities of long-term debt through 2005

and thereafter, excluding capital lease obligations, are 2001 –

$2.4 million; 2002 – $1.7 billion; 2003 – $1 million; 2004 –

$0.2 million; 2005 – $352 million and $251 million thereafter.

Note 12 Leases

We have non-cancelable commitments under both capital

and long-term operating leases, primarily for our restaurants.

Capital and operating lease commitments expire at various

dates through 2087 and, in many cases, provide for rent esca-

lations and renewal options. Most leases require us to pay

related executory costs, which include property taxes, mainte-

nance and insurance.

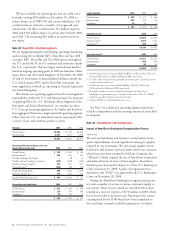

Future minimum commitments and sublease receivables

under non-cancelable leases are set forth below:

Commitments Sublease Receivables

Direct

Capital Operating Financing Operating

2001 $÷12 $÷«194 $÷2 $10

2002 12 176 2 9

2003 11 154 1 8

2004 11 137 1 7

2005 10 127 1 6

Thereafter 94 630 9 37

$150 $1,418 $16 $77

At year-end 2000, the present value of minimum payments

under capital leases was $74 million.

The details of rental expense and income are set forth below:

2000 1999 1998

Rental expense

Minimum $253 $263 $308

Contingent 28 28 25

$281 $291 $333

Minimum rental income $÷18 $÷20 $÷18

Contingent rentals are generally based on sales levels in

excess of stipulated amounts contained in the lease agreements.

Note 13 Financial Instruments

Derivative Instruments

Our policy prohibits the use of derivative instruments for

trading purposes, and we have procedures in place to monitor

and control their use. Our use of derivative instruments has

included interest rate swaps, collars and forward rate agree-

ments. In addition, we utilize on a limited basis, foreign

currency forward contracts and commodity futures and options

contracts. Our interest rate and foreign currency derivative

contracts are entered into with financial institutions while

our commodity contracts are generally exchange traded.

We enter into interest rate swaps, collars, and forward rate

agreements with the objective of reducing our exposure to

interest rate risk for a portion of our debt and to lower our

overall borrowing costs. Reset dates and the floating rate

indices on the swaps and forward rate agreements match

those of the underlying bank debt. Accordingly, any change

in market value associated with the swaps and forward rate

agreements is offset by the opposite market impact on the

related debt. At December 30, 2000 and December 25,

1999, we had outstanding pay-fixed interest rate swaps with

notional amounts of $450 million and $800 million, respec-

tively. At December 30, 2000 we also had outstanding

pay-variable interest rate swaps with notional amounts of

$350 million. Under the contracts, we agree with other par-

ties to exchange, at specified intervals, the difference between

variable rate and fixed rate amounts calculated on a notional

principal amount. We had an aggregate receivable under the

related swaps of $0.9 million and $0.4 million at December 30,

2000 and December 25, 1999, respectively. The swaps mature

at various dates through 2005.

During 2000 and 1999, we entered

into interest rate collars to reduce interest

rate sensitivity on a portion of our variable

rate bank debt. Interest rate collars

effectively lock in a range of interest

rates by establishing a cap and floor.

Reset dates and the floating index

on the collars match those of

the underlying bank debt.