Pizza Hut 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 61

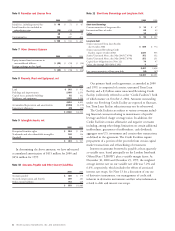

the ultimate cost of the AmeriServe bankruptcy reorganiza-

tion process will not materially exceed the amounts already

provided. A summary of the expense is as follows:

DIP Facility $÷«70

Gross Settlement Amount 246

Less: Dismissed Payables (101)

Residual Assets (86)

Net Settlement Amount 59

TDPP and Other 41

Bankruptcy Causes of Action –

$«170

Each of the amounts in this table is more fully

described below.

DIP Facility

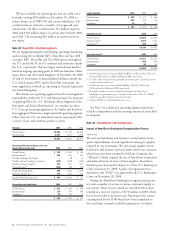

On February 2, 2000, AmeriServe was provided with a

$150 million interim debtor-in-possession (“DIP”) revolving

credit facility (the “DIP Facility”). Through a series of trans-

actions, our effective net commitment under the DIP Facility

was $70 million. At November 30, 2000, the total DIP com-

mitment had essentially been funded.

Replacement Lien

During the bankruptcy reorganization process, we consented

to a cash collateral order by the U.S. Bankruptcy Court

under which the pre-petition secured lenders of AmeriServe

agreed to allow certain AmeriServe pre-petition collateral

(principally inventory and receivables) to be used in the nor-

mal course of business. In exchange, we agreed to grant a lien

(“Replacement Lien”) to these lenders on inventory that we

purchased and the receivables resulting from the sale of this

inventory under the Temporary Direct Purchase Program

described below.

AmeriServe POR

The POR provided for the sale of the AmeriServe U.S. distri-

bution business to McLane effective on November 30, 2000.

In connection with this sale, we have agreed to (a) an extension

of the sales and distribution agreement for U.S. Company-

owned stores (the “Distribution Agreement”) through

October 31, 2010; (b) a five-percent increase in distribution

fees under the Distribution Agreement; and (c) a reduction

in our payment terms for supplies from 30 to 15 days.

Beginning on November 30, 2000 (the closing date of the

sale), McLane assumed all supply and distribution responsi-

bilities under our Distribution Agreement, as well as under

the distribution agreements of most of our franchisees and

licensees previously serviced by AmeriServe.

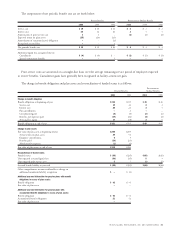

Under the terms of the POR, TRICON provided approxi-

mately $246 million to AmeriServe (the “Gross Settlement

Amount”) to facilitate a global settlement with holders of

allowed secured and administrative priority claims in the

bankruptcy. In exchange, TRICON will receive the proceeds

from the liquidation of AmeriServe’s remaining inventory,

accounts receivable and certain other assets (the “Residual

Assets”). We have currently estimated these proceeds to be

approximately $86 million and have recorded a receivable

from the AmeriServe bankruptcy estate in this amount. We

expect that these proceeds will be primarily realized over

the next twelve months. Through March 9, 2001, we have

collected approximately $29 million.

The POR also released us from any further obligations or

claims under the Replacement Lien and provided for the dis-

missal of the legal action filed by AmeriServe against TRICON

seeking payment of the $101 million in pre-petition trade

accounts payable to AmeriServe (the “Dismissed Payables”).

As previously disclosed, we had accrued for, but withheld

payment of the Dismissed Payables.

In addition, the POR grants TRICON a priority right to

proceeds (up to a maximum of $220 million) from certain

litigation claims and causes of action held by the AmeriServe

bankruptcy estate, including certain avoidance and preference

actions (collectively, the “Bankruptcy Causes of Action”).

We expect that any such proceeds, the potential amounts of

which are not yet reasonably estimable, will be primarily

realized over the next twelve to twenty-four months. These

recoveries, if any, will be recorded as unusual items as they

are realized.

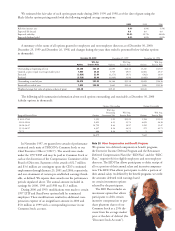

Temporary Direct Purchase Program

During the bankruptcy reorganization process, to help ensure

that our supply chain remained open, we purchased supplies

directly from suppliers for use in our restaurants, as well as

for resale to our franchisees and licensees who previously pur-

chased supplies from AmeriServe (the “Temporary Direct

Purchase Program” or “TDPP”). AmeriServe agreed, for the

same fee in effect prior to the bankruptcy filing, to continue to

be responsible for distributing supplies to us and our partici-

pating franchisee and licensee restaurants. Operations under

the TDPP ceased on November 30, 2000, the date on which

McLane purchased AmeriServe’s U.S. distribution business.

In connection with the TDPP, we incurred approximately

$41 million of costs, principally related to allowances for

estimated uncollectible receivables from our franchisees and

licensees and the incremental interest cost arising from the

additional debt required to finance the inventory purchases

and the receivables arising from supply sales to our franchisees

and licensees. These costs also included inventory obsoles-

cence and certain general and administrative expenses. Under

SFAS No. 45, “Accounting for Franchise Fee Revenue,” the

results of these agency distribution activities are reported on a

net basis in the Consolidated Statement of Income.

At December 30, 2000, our remaining receivables from

franchisees and licensees for sales of supplies under the TDPP

were approximately $52 million, net of related allowances for

doubtful accounts. The Company intends to vigorously pur-

sue collection of these receivables. Through March 9, 2001,