Pizza Hut 2000 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

we have collected approximately $43 million. On November

30, 2000, we sold our remaining inventories to McLane at an

amount approximating book value. We have no remaining

payables to suppliers under the TDPP.

Other

We have incurred and will continue to incur other incremental

costs (principally professional fees) as a result of the AmeriServe

bankruptcy reorganization process which are being charged as

incurred to unusual items. We expect that these costs, though

substantially reduced from pre-POR levels, will continue until

the affairs of the estate can be substantially concluded; however,

we do not expect that these costs, net of any recoveries from

the Bankruptcy Causes of Action, will be material to our

annual results of operations, financial condition or cash flows.

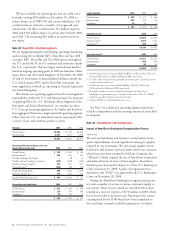

Other Commitments and Contingencies

Contingent Liabilities

We were directly or indirectly contingently liable in the

amounts of $401 million and $386 million at year-end 2000

and 1999, respectively, for certain lease assignments and

guarantees. At December 30, 2000, $333 million represented

contingent liabilities to lessors as a result of assigning our

interest in and obligations under real estate leases as a condi-

tion to the refranchising of Company restaurants and the

contribution of certain Company restaurants to a new venture

in Canada. The $333 million represented the present value of

the minimum payments of the assigned leases, excluding any

renewal option periods, discounted at our pre-tax cost of debt.

On a nominal basis, the contingent liability resulting from

the assigned leases was $513 million. The remaining amounts

of the contingent liabilities primarily relates to our guarantees

to support financial arrangements of certain unconsolidated

affiliates and franchisees. The contingent liabilities related to

financial arrangements of franchisees include partial guarantees

of franchisee loan pools originated primarily in connection

with the Company’s refranchising programs. In support of

these guarantees, we have posted $22 million of letters of

credit and $10 million in cash collateral. The cash collateral

balances are included in Other Assets. Also, TRICON pro-

vides a standby letter of credit under which TRICON could

potentially be required to fund a portion (up to $25 million)

of one of the franchisee loan pools discussed above. Any such

funding under the standby letter of credit would then be

fully secured by franchisee loan collateral. We have provided

for our estimated probable exposures under these contingent

liabilities largely through charges to refranchising gains (losses).

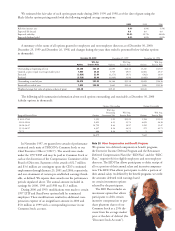

Casualty Loss Programs and Estimates

We are currently self-insured for a portion of our current and

prior years’ casualty losses, property losses and certain other

insurable risks. To mitigate the cost of our exposures for cer-

tain casualty losses, we make annual decisions to either retain

the risks of loss up to certain maximum per occurrence or

aggregate loss limits negotiated with our insurance carriers or

to fully insure those risks. Since the Spin-off, we have elected

to retain the risks subject to insured limitations. In addition,

we also purchased insurance in 1998 to limit the cost for

certain of our retained risks for the years 1994 to 1996.

Effective August 16, 1999, we made changes to our U.S.

and portions of our International property and casualty loss

programs. For fiscal year 2000 and the period from August 16,

1999 through fiscal year end, 1999, we bundled our risks for

casualty losses, property losses and various other insurable

risks into one risk pool with a single maximum loss limit.

Certain losses in excess of the single maximum loss limit

are covered under reinsurance agreements. Since all of these

risks have been pooled and there are no per occurrence limits

for individual claims, it is possible that we may experience

increased volatility in property and casualty losses on a quarter

to quarter basis. This would occur if an individual large loss

is incurred either early in a program year or when the latest

actuarial projection of losses for a program year is significantly

below our aggregate loss retention. A large loss is defined as

a loss in excess of $2 million which was our predominant

per occurrence casualty loss limit under our previous insur-

ance program.

We have accounted for our retained liabilities for casualty

losses, including reported and incurred but not reported

claims, based on information provided by our independent

actuary. Effective August 16, 1999, property losses are also

included in our actuary’s valuation. Prior to that date, prop-

erty losses were based on our internal estimates.

Actuarial valuations are performed and resulting adjust-

ments to current and prior years’ self-insured casualty losses,

property losses and other insurable risks, are made in the sec-

ond and fourth quarters of each fiscal year. The adjustments

recorded to our casualty loss reserves in 2000 were insignificant.

We recorded favorable adjustments of $30 million in 1999

and $23 million in 1998. The 1999 and 1998 adjustments

resulted primarily from improved loss trends related to 1998

casualty losses at all three of our U.S. Concepts. In addition,

the favorable insurance adjustments in 1998 included the

benefit of the insurance transaction to limit the cost for

certain of our retained risk for the years 1994 to 1996.

We will continue to make adjustments both based on our

actuary’s periodic valuations as well

as whenever there are significant

changes in the expected costs of

settling large claims that have

occurred since the last actuarial

valuation was performed.