Pizza Hut 2000 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 49

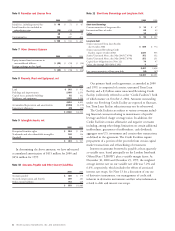

1997 Fourth Quarter Charge

In the fourth quarter of 1997, we recorded a $530 million

unusual charge ($425 million after-tax). The charge included

estimates for (a) costs of closing stores, primarily at Pizza Hut

and Tricon Restaurants International; (b) reductions to fair

market value, less costs to sell, of the carrying amounts of

certain restaurants we intended to refranchise; (c) impairments

of certain restaurants intended to be used in the business;

(d) impairments of certain investments in unconsolidated

affiliates to be retained; and (e) costs of related personnel

reductions. Below is a summary of the 1999 and 1998 activ-

ity related to our asset valuation allowances and liabilities

recognized as a result of the 1997 fourth quarter charge:

Asset

Valuation

Allowances Liabilities Total

Balance at December 27, 1997 $261 $129 $390

Amounts used (131) (54) (185)

(Income) expense impacts:

Completed transactions (27) (7) (34)

Decision changes (22) (17) (39)

Estimate changes 15 (7) 8

Other 1–1

Balance at December 26, 1998 97 44 141

Amounts used (87) (32) (119)

(Income) expense impacts:

Completed transactions (5) –(5)

Decision changes 1(3) (2)

Estimate changes (7) (9) (16)

Other 1–1

Balance at December 25, 1999 $÷÷– $÷÷– $÷÷–

During 1999 and 1998, we continued to re-evaluate our

prior estimates of the fair market value of units to be refran-

chised or closed and other liabilities arising from the charge.

In 1999, we recorded favorable adjustments of $13 million

($10 million after-tax) and $11 million ($10 million after-

tax) included in facility actions net gain and unusual items,

respectively. In 1998, favorable adjustments of $54 million

($33 million after-tax) and $11 million ($7 million after-tax)

were included in facility actions net gain and unusual items,

respectively. The 1999 and 1998 adjustments primarily related

to decisions to retain certain stores originally expected to be

disposed of, lower-than-expected losses from stores disposed

of, favorable lease settlements with certain lessors related to

stores closed and changes in estimated costs.

Our operating profit reflects the benefit from the suspen-

sion of depreciation and amortization of approximately

$12 million ($7 million after-tax) and $33 million ($21 mil-

lion after-tax) in 1999 and 1998, respectively, for stores held

for disposal. The benefits from the suspension of depreciation

and amortization related to stores that were operating at the

end of the respective periods ceased when the stores were

refranchised or closed or a subsequent decision was made to

retain the stores.

Confidence level means the likelihood that our actual casualty

losses will be equal to or below those estimates. Based on our

independent actuary’s opinion, our prior practice produced a

very conservative confidence factor at a level higher than our

target of 75%. Our actuary now provides an actuarial esti-

mate at our targeted 75% confidence level in the aggregate

for all self-insured years. The change in methodology resulted

in a one-time increase in our 1999 operating profit of over

$8 million.

At the end of 1998, we changed our method of determin-

ing the pension discount rate to better reflect the assumed

investment strategies we would most likely use to invest any

short-term cash surpluses. Accounting for pensions requires

us to develop an assumed interest rate on securities with which

the pension liabilities could be effectively settled. In estimating

this discount rate, we look at rates of return on high-quality

corporate fixed income securities currently available and

expected to be available during the period to maturity of the

pension benefits. As it is impractical to find an investment

portfolio which exactly matches the estimated payment stream

of the pension benefits, we often have projected short-term

cash surpluses. Previously, we assumed that all short-term cash

surpluses would be invested in U.S. government securities.

Our new methodology assumes that our investment strategies

would be equally divided between U.S. government securities

and high-quality corporate fixed income securities. The pension

discount methodology change resulted in a one-time increase

in our 1999 operating profit of approximately $6 million.

Human Resource and Accounting Standardization Programs

In 1999, our vacation policies were conformed to a calendar-

year based, earn-as-you-go, use-or-lose policy. The change

provided a one-time favorable increase in our 1999 operating

profit of approximately $7 million. Other accounting policy

standardization changes by our three U.S. Concepts provided

a one-time favorable increase in our 1999 operating profit of

approximately $1 million.

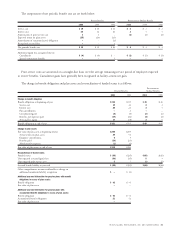

Our 1999 operating results included the favorable impact

of approximately $29 million ($18 million after-tax or $0.11

per diluted share) from these accounting changes. The esti-

mated impact is summarized below:

1999

Restaurant Operating

Margin G&A Profit

U.S. $11 $÷4 $15

Unallocated –1414

Total $11 $18 $29