Pizza Hut 2000 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

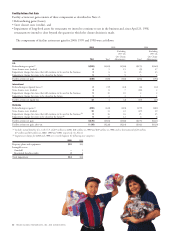

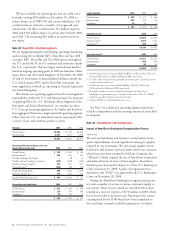

Facility Actions Net Gain

Facility actions net gain consists of three components as described in Note 2:

• Refranchising gains (losses),

• Store closure costs (credits), and

• Impairment of long-lived assets for restaurants we intend to continue to use in the business and, since April 23, 1998,

restaurants we intend to close beyond the quarter in which the closure decision is made.

The components of facility actions net gain for 2000, 1999 and 1998 were as follows:

2000 1999 1998

(Excluding (Excluding

1997 4th 1997 4th

Qtr. Charge Qtr. Charge

Total Total Adjustments) Total Adjustments)

U.S.

Refranchising net gains(a) $(202) $(405) $(396) $(275) $(249)

Store closure costs (credits) 6515 (9) 27

Impairment charges for stores that will continue to be used in the business 36 6 23 23

Impairment charges for stores to be closed in the future 59955

Facility actions net gain (188) (385) (366) (256) (194)

International

Refranchising net (gains) losses(a) 2(17) (22) (4) (32)

Store closure costs (credits) 48 7 (18) 2

Impairment charges for stores that will continue to be used in the business 510 10 2 2

Impairment charges for stores to be closed in the future 13311

Facility actions net (gain) loss 12 4(2) (19) (27)

Worldwide

Refranchising net gains(a) (200) (422) (418) (279) (281)

Store closure costs (credits) 10 13 22 (27) 29

Impairment charges for stores that will continue to be used in the business(b) 816 16 25 25

Impairment charges for stores to be closed in the future(b) 612 12 6 6

Facility actions net gain $(176) $(381) $(368) $(275) $(221)

Facility actions net gain, after-tax $÷(98) $(226) $(216) $(162) $(129)

(a) Includes initial franchise fees in the U.S. of $17 million in 2000, $38 million in 1999 and $39 million in 1998, and in International of $3 million,

$7 million and $5 million in 2000, 1999 and 1998, respectively. See Note 6.

(b) Impairment charges for 2000 and 1999 were recorded against the following asset categories:

2000 1999

Property, plant and equipment $12 $25

Intangible assets:

Goodwill –1

Reacquired franchise rights 22

Total impairment $14 $28

50 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES