Pizza Hut 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 27

Depending upon the facts and circumstances of each

situation, and in the absence of an improvement in business

trends, there are a number of potential resolutions of these

financial issues, including a sale of some or all of the opera-

tor’s restaurants to us or a third party, a restructuring of the

operator’s business and/or finances, or, in the more unusual

cases, bankruptcy of the operator. It is our practice to proac-

tively work with financially troubled franchise operators in

an attempt to positively resolve their issues.

Taco Bell has established a $15 million loan program

for those franchisees in need of short-term assistance due to

the recent sales declines in the Taco Bell system. Through

February 2001, this program has aided approximately 75

franchisees covering approximately 1,500 Taco Bell restaurants.

Additionally, Taco Bell is in various stages of discussions with

a number of other Taco Bell franchisees and their lenders. We

believe that many of these franchisees will require various types

of business and/or financial restructuring. Based on currently

available information, we believe that this group of franchisees

represents approximately 1,000 Taco Bell restaurants.

In 2000, we charged approximately $26 million to ongoing

operating profit for expenses related to the financial situation

of certain Taco Bell franchisees. These expenses, which relate

primarily to allowances for doubtful franchise and license fee

receivables, were reported as general and administrative

expenses. On an ongoing basis, we assess our exposure from

franchise-related risks which include estimated uncollectibil-

ity of accounts receivable related to franchise and license fees,

contingent lease liabilities, guarantees to support certain third

party financial arrangements with franchisees and potential

claims by franchisees. The contingent lease liabilities and

guarantees are more fully discussed in the Contingent Liabili-

ties section of Note 21. Although the ultimate impact of these

franchise financial issues cannot be predicted with certainty

at this time, we have provided for our current estimate of the

probable exposure to the Company as of December 30, 2000.

It is reasonably possible that there will be additional costs

which could be material to quarterly or annual results of

operations, financial condition or cash flows.

Based on the information currently available to us, we have

budgeted for an estimate of expenses and capital expenditures

that may be required to address this situation. However, the

Taco Bell franchise financial situation poses certain risks and

uncertainties to us. The more significant of these risks and

uncertainties are described below. Significant adverse develop-

ments in this situation, or in any of these risks or uncertainties,

could have a material adverse impact on our quarterly or

annual results of operations, financial condition or cash flows.

We intend to continue to proactively work with financially

troubled franchise operators in an attempt to positively resolve

their issues. However, there can be no assurance that the

number of franchise operators or restaurants experiencing

financial difficulties will not change from our current estimates.

Nor can there be any assurance that we will be successful in

resolving financial issues relating to any specific franchise

operator. Additionally, there can be no assurance that resolu-

tion of these financial issues will not result in Taco Bell

purchasing a significant number of restaurants from financially

troubled Taco Bell franchise operators.

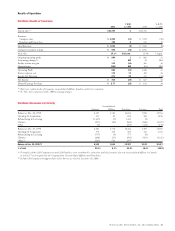

Unusual Items

We recorded unusual items of $204 million ($129 million

after-tax), $51 million ($29 million after-tax) and $15 million

($3 million after-tax) in 2000, 1999 and 1998, respectively.

See Note 5 for a detailed discussion of our unusual items.

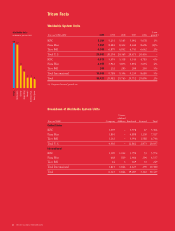

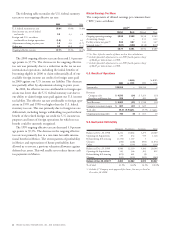

Fifty-third Week in 2000

Our fiscal calendar results in a fifty-third week every 5 or 6

years. Fiscal year 2000 included a fifty-third week in the

fourth quarter. The following table summarizes the estimated

impact of the fifty-third week on system sales, revenues and

ongoing operating profit:

Inter-

U.S. national Unallocated Total

System sales $230 $65 $«– $295

Revenues

Company sales $÷58 $18 $«– $÷76

Franchise fees 92–11

Total Revenues $÷67 $20 $«– $÷87

Ongoing operating profit

Franchise fees $÷÷9 $÷2 $«– $÷11

Restaurant margin 114–15

General and administrative

expenses (3) (2) (2) (7)

Ongoing operating profit $÷17 $÷4 $(2) $÷19

The estimated favorable impact in net income was $10 mil-

lion or $0.07 per diluted share.