Pizza Hut 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 37

Financing Activities

Our primary bank credit agreement, as amended in 2000 and

1999, is comprised of a senior, unsecured Term Loan Facility

and a $3 billion senior unsecured Revolving Credit Facility

(collectively referred to as the “Credit Facilities”), both of

which mature on October 2, 2002. Amounts outstanding

under our Revolving Credit Facility are expected to fluctuate,

but Term Loan Facility reductions may not be reborrowed.

At December 30, 2000, we had unused Revolving Credit

Facility borrowings available aggregating $1.8 billion, net of

outstanding letters of credit of $190 million. We believe that

we will be able to refinance a portion of our Credit Facilities

with publicly issued bonds within the next twelve months.

As a result of this refinancing, we are likely to experience an

increase in our interest rates, subject to rates available at the

time of refinancing. We also believe we will be able to replace

or refinance the remaining Credit Facilities prior to maturity

with new borrowings which will reflect the market conditions

or terms available at that time.

The Credit Facilities subject us to significant interest expense

and principal repayment obligations, which are limited in

the near term, to prepayment events as defined in the credit

agreement. Interest on the Credit Facilities is based princi-

pally on the London Interbank Offered Rate (“LIBOR”) plus

a variable margin factor as defined in the credit agreement.

Therefore, our future borrowing costs may fluctuate depend-

ing upon the volatility in LIBOR. We currently mitigate a

portion of our interest rate risk through the use of derivative

financial instruments. See Notes 11 and 13 and our market

risk discussion for further discussions of our interest rate risk.

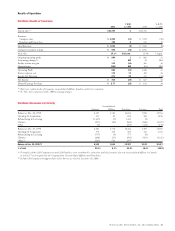

Consolidated Financial Condition

Assets increased $188 million or 5% to $4.1 billion. The

increase is primarily attributable to the increase in receivables

arising from the impact of the AmeriServe bankruptcy reor-

ganization process as more fully discussed in Note 21.

Liabilities decreased $50 million or 1% to $4.5 billion.

Excluding the impact of the aforementioned increase in

accounts receivable arising from the AmeriServe bankruptcy

reorganization process, our working capital deficit decreased

8% to approximately $769 million at December 30, 2000

from $832 million at December 25, 1999. The decline was

primarily due to a reduction in accounts payable related to

fewer Company restaurants as a result of our portfolio

actions, a change in payment terms to our new primary U.S.

distributor of food and paper and a reduction in accrued

compensation. These decreases were partially offset by an

increase in accrued income taxes.

We believe the Company has adequate financial resources

to meet its requirements in 2001 and beyond.

Other Significant Known Events, Trends or Uncertainties

Expected to Impact 2001 Ongoing Operating Profit

Comparisons with 2000

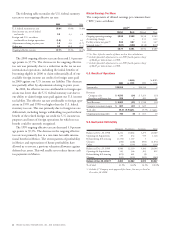

Impact of New Unconsolidated Affiliates

Consistent with our strategy to focus our capital on key

international markets, we entered into an agreement in 1999

to form a new venture during 2000 in Canada with our largest

franchisee in that market. During the third quarter of 2000,

we contributed 320 restaurants in exchange for a 50% equity

interest in the venture. These stores represented approximately

16% of the total International Company restaurants at the

time of the formation of the new venture. Including the stores

contributed by our partner, the new venture had approximately

650 restaurants at the time of formation. We did not record

any gain or loss on the transfer of assets to this new venture.

Previously, the results from the restaurants we contributed

to the Canadian venture were consolidated. The impact of

this transaction on operating results is similar to the Portfolio

Effect of our refranchising activities. Consequently, this

transaction will result in a decline in our Company sales,

restaurant margin dollars and G&A expenses as well as higher

franchise fees and equity income. In addition to the Portfolio

Effect, franchise fees will be higher since the royalty rate was

increased for those stores contributed by our partner to this

venture. The overall impact from the formation of this ven-

ture on 2000 ongoing operating profit was slightly favorable.

Had this venture been formed at the beginning of 2000, our

International Company sales would have declined approxi-

mately 10% compared to the reported decline of 4% for the

year ended December 30, 2000.

In addition, we anticipate contributing about 50 restau-

rants to a new venture in Poland to be formed in 2001. We

believe the impact on ongoing operating profit from the

formation of the venture will not be significant.

Impact of the Consolidation of an Unconsolidated Affiliate

Beginning in fiscal 2001, we will consolidate a previously

unconsolidated affiliate in our Consolidated Financial State-

ments as a result of a change in our intent to temporarily

retain control of this affiliate. While we believe that the overall

impact on our ongoing operating profit will not be signifi-

cant, this change is expected to result in higher Company sales,

restaurant margin dollars and G&A as well as decreased fran-

chise fees and equity income. Had this change occurred at the

beginning of 2000, our International Company sales would

have increased approximately 2% compared to the reported

decline of 4% for the year ended December 30, 2000.