Pizza Hut 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

Store Portfolio Strategy

Beginning in 1995, we have been strategically reducing our

share of total system units by selling Company restaurants to

existing and new franchisees where their expertise can generally

be leveraged to improve our overall operating performance,

while retaining Company ownership of key U.S. and Inter-

national markets. This portfolio-balancing activity has reduced,

and will continue to reduce, our reported revenues and restau-

rant profits and has increased the importance of system sales

as a key performance measure. We expect to substantially

complete our refranchising program in 2001.

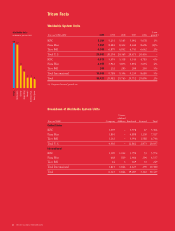

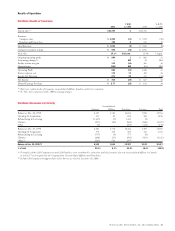

The following table summarizes our refranchising activi-

ties for the last three years:

2000 1999 1998

Number of units refranchised 757 1,435 1,373

Refranchising proceeds, pre-tax $381 $«««916 $«««784

Refranchising net gains, pre-tax $200 $«««422 $«««279

In addition to our refranchising program, we have been

closing restaurants over the past several years. Restaurants

closed include poor performing restaurants, restaurants that

are relocated to a new site within the same trade area or U.S.

Pizza Hut delivery units consolidated with a new or existing

dine-in traditional store within the same trade area.

The following table summarizes Company store closure

activities for the last three years:

2000 1999 1998

Number of units closed 208 301 572

Store closure costs (credits) (a) $««10 $««13 $«(27)

Impairment charges for stores to be

closed in the future $««÷6 $««12 $«÷«6

(a) Includes favorable adjustments to our 1997 fourth quarter charge of

$9 million in 1999 and $56 million in 1998.

The impact on ongoing operating profit arising from our

refranchising and store closure initiatives as well as the contri-

bution of Company stores to a new unconsolidated affiliate

as described in the Impact of New Unconsolidated Affiliates

section (the “Portfolio Effect”), represents the net of (a) the

estimated reduction in Company sales, restaurant margin

and general and administrative expenses (“G&A”), (b) the

estimated increase in franchise fees and (c) the equity income

(loss) from investments in unconsolidated affiliates (“equity

income”). The amounts presented below reflect the estimated

impact from stores that were operated by us for all or some

portion of the comparable period in the respective previous

year and were no longer operated by us as of the last day of

the respective year.

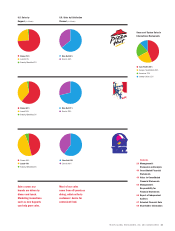

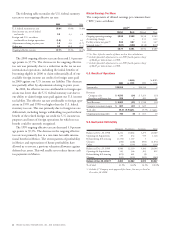

The following table summarizes the estimated revenue

impact of the Portfolio Effect:

2000

U.S. International Worldwide

Reduced sales $«««(838) $(246) $(1,084)

Increased franchise fees 39 13 52

Reduction in total revenues $«««(799) $(233) $(1,032)

1999

U.S. International Worldwide

Reduced sales $(1,065) $(201) $(1,266)

Increased franchise fees 51 9 60

Reduction in total revenues $(1,014) $(192) $(1,206)

The following table summarizes the estimated impact on

ongoing operating profit of the Portfolio Effect:

2000

U.S. International Worldwide

Decreased restaurant margin $««(90) $(25) $(115)

Increased franchise fees 39 13 52

Decreased G&A 11 6 17

Equity income (loss) – (1) (1)

(Decrease) in ongoing operating profit $««(40) $÷(7) $÷(47)

1999

U.S. International Worldwide

Decreased restaurant margin $(108) $(18) $(126)

Increased franchise fees 51 9 60

Decreased G&A 17 10 27

(Decrease) increase in ongoing

operating profit $÷(40) $÷«1 $÷(39)

The estimated interest savings resulting from the reduction

of average debt with the net after-tax cash proceeds from our

refranchising activities largely mitigated the above reduction

in ongoing operating profit.