Pizza Hut 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 39

subject to tax considerations and local regulatory restrictions

which limit our ability to utilize these funds outside the

country in which they are held.

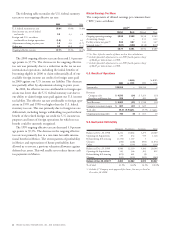

At December 30, 2000, a hypothetical 100 basis point

increase in short-term interest rates would result in a reduc-

tion of $19 million in annual income before income taxes.

The estimated reduction is based upon the unhedged portion

of our variable rate debt and assumes no change in the volume

or composition of debt at December 30, 2000. In addition,

the fair value of our interest rate derivative contracts would

decrease approximately $11 million in value to us, and the

fair value of our Senior Unsecured Notes would decrease

approximately $25 million. Fair value was determined by

discounting the projected cash flows.

New Accounting Pronouncement

See Note 2.

Cautionary Statements

From time to time, in both written reports and oral state-

ments, we present “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of

1934, as amended. The statements include those identified by

such words as “may,” “will,” “expect,” “anticipate,” “believe,”

“plan” and other similar terminology. These “forward-looking

statements” reflect our current expectations and are based upon

data available at the time of the statements. Actual results

involve risks and uncertainties, including both those specific

to the Company and those specific to the industry, and could

differ materially from expectations.

Company risks and uncertainties include, but are not

limited to, potentially substantial tax contingencies related

to the Spin-off, which, if they occur, require us to indemnify

PepsiCo, Inc.; our substantial debt leverage and the attendant

potential restriction on our ability to borrow in the future, as

well as our substantial interest expense and principal repay-

ment obligations; our ability to replace or refinance the Credit

Facilities at reasonable rates; potential unfavorable variances

between estimated and actual liabilities including the liabili-

ties related to the sale of the non-core businesses; the ongoing

business viability of our key distributor of restaurant products

and equipment in the U.S. and our ability to ensure adequate

supply of restaurant products and equipment in our stores; our

ability to complete our Euro conversion plans or the ability of

our key suppliers to be Euro-compliant; the ongoing financial

viability of our franchisees and licensees, our potential inabil-

ity to identify qualified franchisees to purchase restaurants at

prices we consider appropriate under our strategy to reduce

the percentage of system units we operate; volatility of actu-

arially determined casualty loss estimates and adoption of

new or changes in accounting policies and practices.

Industry risks and uncertainties include, but are not limited

to, global and local business, economic and political condi-

tions; legislation and governmental regulation; competition;

success of operating initiatives and advertising and promo-

tional efforts; volatility of commodity costs and increases in

minimum wage and other operating costs; availability and

cost of land and construction; consumer preferences, spend-

ing patterns and demographic trends; political or economic

instability in local markets and currency exchange rates.