Pizza Hut 2000 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

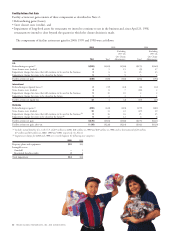

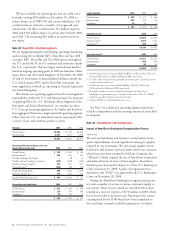

Note 6 Franchise and License Fees

2000 1999 1998

Initial fees, including renewal fees $÷÷48 $÷÷«÷71 $÷÷÷67

Initial franchise fees included in

refranchising gains (20) (45) (44)

28 26 23

Continuing fees 760 697 604

$÷788 $÷÷«723 $÷÷627

Note 7 Other (Income) Expense

2000 1999 1998

Equity income from investments in

unconsolidated affiliates $÷«(25) $÷÷÷(19) $÷÷«(18)

Foreign exchange net loss (gain) –3(6)

$÷«(25) $÷÷÷(16) $÷÷«(24)

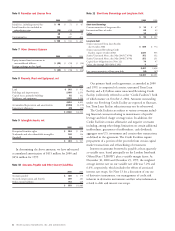

Note 8 Property, Plant and Equipment, net

2000 1999

Land $÷÷543 $÷÷572

Buildings and improvements 2,469 2,553

Capital leases, primarily buildings 82 102

Machinery and equipment 1,522 1,598

4,616 4,825

Accumulated depreciation and amortization (2,056) (2,279)

Impairment allowances (20) (15)

$÷2,540 $«2,531

Note 9 Intangible Assets, net

2000 1999

Reacquired franchise rights $÷÷«264 $÷÷326

Trademarks and other identifiable intangibles 102 124

Goodwill 53 77

$÷÷«419 $÷÷527

In determining the above amounts, we have subtracted

accumulated amortization of $415 million for 2000 and

$456 million for 1999.

Note 10 Accounts Payable and Other Current Liabilities

2000 1999

Accounts payable $÷÷«326 $«÷«375

Accrued compensation and benefits 209 281

Other current liabilities 443 429

$÷÷«978 $«1,085

Note 11 Short-term Borrowings and Long-term Debt

2000 1999

Short-term Borrowings

Current maturities of long-term debt $÷÷«10 $÷÷«47

International lines of credit 68 45

Other 12 25

$«««««90 $«««117

Long-term Debt

Senior, unsecured Term Loan Facility,

due October 2002 $÷«689 $÷«774

Senior, unsecured Revolving Credit

Facility, expires October 2002 1,037 955

Senior, Unsecured Notes, due May 2005 (7.45%) 351 352

Senior, Unsecured Notes, due May 2008 (7.65%) 251 251

Capital lease obligations (see Note 12) 74 97

Other, due through 2010 (6%

–

11%) 59

2,407 2,438

Less current maturities of long-term debt (10) (47)

$2,397 $2,391

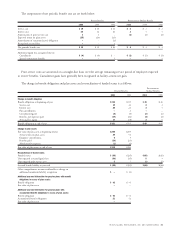

Our primary bank credit agreement, as amended in 2000

and 1999, is comprised of a senior, unsecured Term Loan

Facility and a $3 billion senior unsecured Revolving Credit

Facility (collectively referred to as the “Credit Facilities”) both

of which mature on October 2, 2002. Amounts outstanding

under our Revolving Credit Facility are expected to fluctuate,

but Term Loan Facility reductions may not be reborrowed.

The Credit Facilities are subject to various covenants includ-

ing financial covenants relating to maintenance of specific

leverage and fixed charge coverage ratios. In addition, the

Credit Facilities contain affirmative and negative covenants

including, among other things, limitations on certain additional

indebtedness, guarantees of indebtedness, cash dividends,

aggregate non-U.S. investment and certain other transactions,

as defined in the agreement. The Credit Facilities require

prepayment of a portion of the proceeds from certain capital

market transactions and refranchising of restaurants.

Interest on amounts borrowed is payable at least quarterly

at variable rates, based principally on the London Interbank

Offered Rate (“LIBOR”) plus a variable margin factor. At

December 30, 2000 and December 25, 1999, the weighted

average interest rate on our variable rate debt was 7.2% and

6.6%, respectively, which includes the effects of associated

interest rate swaps. See Note 13 for a discussion of our use

of derivative instruments, our management of credit risk

inherent in derivative instruments and fair value information

related to debt and interest rate swaps.