Pizza Hut 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 47

previously closed stores. These costs are expensed as incurred.

Additionally, we record a liability for the net present value of

any remaining operating lease obligations after the expected

closure date, net of estimated sublease income, if any, at the

date the closure is considered probable.

Considerable management judgment is necessary to esti-

mate future cash flows. Accordingly, actual results could vary

significantly from the estimates.

Impairment of Long-Lived Assets

We review our long-lived assets related to each restaurant

to be held and used in the business, including any allocated

intangible assets, semi-annually for impairment, or whenever

events or changes in circumstances indicate that the carrying

amount of a restaurant may not be recoverable. We evaluate

restaurants using a “two-year history of operating losses” as

our primary indicator of potential impairment. Based on the

best information available, we write down an impaired restau-

rant to its estimated fair market value, which becomes its new

cost basis. We generally measure estimated fair market value

by discounting estimated future cash flows. In addition, after

April 23, 1998, when we decide to close a store beyond the

quarter in which the closure decision is made, it is reviewed

for impairment and depreciable lives are adjusted. The impair-

ment evaluation is based on the estimated cash flows from

continuing use until the expected disposal date plus the

expected terminal value.

Considerable management judgment is necessary to esti-

mate future cash flows. Accordingly, actual results could vary

significantly from our estimates.

Impairment of Investments in Unconsolidated Affiliates

and Enterprise-Level Goodwill

Our methodology for determining and measuring impairment

of our investments in unconsolidated affiliates and enterprise-

level goodwill is similar to the methodology we use for our

restaurants except: (a) the recognition test for an investment

in an unconsolidated affiliate compares the carrying amount

of our investment to a forecast of our share of the unconsoli-

dated affiliate’s undiscounted cash flows after interest and

taxes instead of undiscounted cash flows before interest and

taxes used for our restaurants; and (b) enterprise-level good-

will is generally evaluated at a country level instead of by

individual restaurant. Also, we record impairment charges

related to investments in unconsolidated affiliates whenever

other circumstances indicate that a decrease in the value of

an investment has occurred which is other than temporary.

Considerable management judgment is necessary to esti-

mate future cash flows. Accordingly, actual results could vary

significantly from our estimates.

New Accounting Pronouncement Not Yet Adopted

In June 1998, the Financial Accounting Standards Board (the

“FASB”) issued SFAS 133. SFAS 133 establishes accounting

and reporting standards requiring that every derivative instru-

ment (including certain derivative instruments embedded in

other contracts) be recorded in the balance sheet as either an

asset or liability measured at its fair value. SFAS 133 requires

that changes in the derivative’s fair value be recognized currently

in earnings unless specific hedge accounting criteria are met.

Special accounting for qualifying hedges allows a derivative’s

gains and losses to offset the related change in fair value on

the hedged item in the Consolidated Statements of Income

or be deferred through Accumulated Other Comprehensive

Income until a hedged forecasted transaction affects earnings.

SFAS 133 requires that a company formally document, desig-

nate and assess the effectiveness of transactions to receive

hedge accounting treatment. In June 2000, the FASB issued

SFAS No. 138, “Accounting for Certain Derivative Instru-

ments and Certain Hedging Activities,” which amended

certain provisions of SFAS 133.

As required, we adopted these statements on December 31,

2000, which is the beginning of our 2001 fiscal year. The

transition adjustments resulting from the adoption of SFAS 133

were not significant. In addition, the adoption of these state-

ments could increase volatility in our earnings and other

comprehensive income.

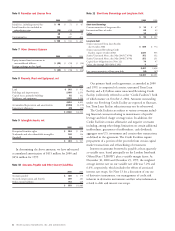

Note 3 Comprehensive Income

Accumulated Other Comprehensive Income of $177 million

and $133 million as of December 30, 2000 and December 25,

1999, respectively, consisted entirely of foreign currency

translation adjustment.

The changes in foreign currency translation adjustment

are as follows:

2000 1999 1998

Foreign currency translation adjustment

arising during the period $(44) $15 $(21)

Less: Foreign currency translation

adjustment included in net income ––1

Net foreign currency translation

adjustment $(44) $15 $(20)