Pizza Hut 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 31

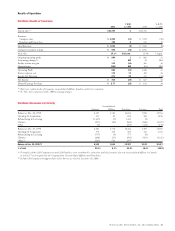

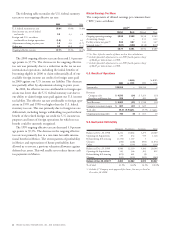

Worldwide Other (Income) Expense

2000 1999 1998

Equity income $(25) $(19) $(18)

Foreign exchange net loss (gain) –3(6)

Other (income) expense $(25) $(16) $(24)

Other (income) expense increased $9 million or 55% in

2000. The increase in equity income was primarily due to

improved results of our unconsolidated affiliates in Japan, the

United Kingdom and China.

In 1999, other (income) expense declined $8 million or

31%. The decline was primarily due to foreign exchange losses

in 1999 versus gains in 1998 related to U.S. dollar denomi-

nated short-term investments in Canada.

Worldwide Facility Actions Net Gain

We recorded facility actions net gain of $176 million in 2000,

$381 million in 1999 and $275 million in 1998. See the Store

Portfolio Strategy section for more details regarding our refran-

chising and closure activities and Note 5 for a summary of the

components of facility actions net gain by operating segment.

Impairment charges for stores that will continue to be

used in the business were $8 million in 2000 compared to

$16 million in 1999 and $25 million in 1998 reflecting fewer

underperforming stores. As a result of the adoption of the

SEC’s interpretation of Statement of Financial Accounting

Standards No. 121 “Accounting for the Impairment of Long-

Lived Assets” (“SFAS 121”) in 1998, we perform impairment

evaluations when we expect to actually close a store beyond

the quarter in which our closure decision is made. This change

resulted in additional impairment charges of $6 million in

2000, $12 million in 1999 and $6 million in 1998. Under

our prior accounting policy, these impairment charges would

have been included in store closure costs in the quarter in

which the closure decision was made.

Worldwide Ongoing Operating Profit

% B(W) % B(W)

2000 vs. 1999 1999 vs. 1998

U.S. ongoing operating

profit $«742 (9) $÷«813 10

International ongoing

operating profit 309 16 265 39

Foreign exchange net loss –NM (3) NM

Ongoing unallocated and

corporate expenses (163) 16 (194) (14)

Ongoing operating profit $«888 1 $881 15

The changes in U.S. and International ongoing operating

profit for 2000 and 1999 are discussed in the respective

sections below.

Ongoing unallocated and corporate expenses decreased

$31 million or 16% in 2000. The decline was primarily

due to lower Year 2000 spending and lower incentive com-

pensation expense.

In 1999, ongoing unallocated and corporate expenses

increased $25 million or 14%. The increase was driven by

higher strategic and other corporate spending, system standard-

ization investment spending and the absence of favorable cost

recovery agreements from AmeriServe and PepsiCo. These

increases were partially offset by the absence of costs associ-

ated with relocating certain of our operations from Wichita,

Kansas in 1998.

Worldwide Interest Expense, Net

2000 1999 1998

Interest expense $190 $218 $291

Interest income (14) (16) (19)

Interest expense, net $176 $202 $272

Our net interest expense decreased $26 million or 13%.

The decline was due to a lower average debt outstanding in

2000 as compared to 1999, partially offset by an increase in

interest rates on our variable rate debt. As discussed in Note 21,

the interest expense on incremental borrowings related to the

AmeriServe bankruptcy reorganization process of $9 million

has been included in unusual items.

In 1999, our net interest expense decreased $70 million or

26%. The decline was primarily due to the reduction of debt

through use of after-tax cash proceeds from our refranchising

activities and cash from operations.

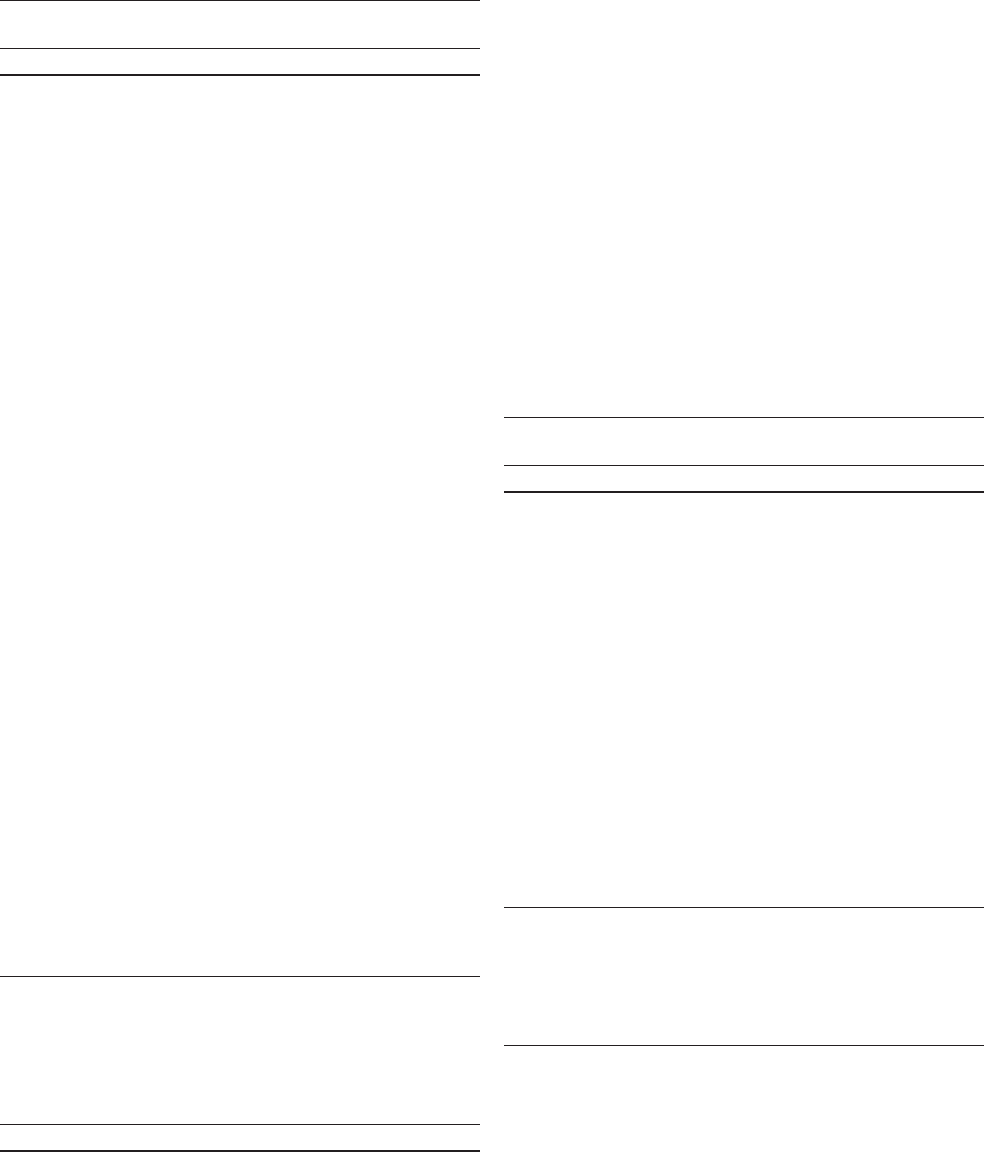

Worldwide Income Taxes

2000 1999 1998

Reported

Income taxes $271 $411 $311

Effective tax rate 39.6% 39.5% 41.1%

Ongoing (a)

Income taxes $268 $267 $210

Effective tax rate 37.7% 39.3% 42.3%

(a) Excludes the effects of facility actions net gain, unusual items and the 1999

accounting changes. See Note 5 for a discussion of these exclusions.