Pizza Hut 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

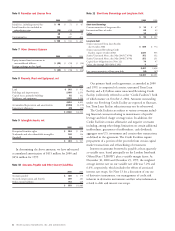

Property, Plant and Equipment

We state property, plant and equipment (“PP&E”) at cost

less accumulated depreciation and amortization, impairment

writedowns and valuation allowances. We calculate deprecia-

tion and amortization on a straight-line basis over the estimated

useful lives of the assets as follows: 5 to 25 years for buildings

and improvements, 3 to 20 years for machinery and equipment

and 3 to 7 years for capitalized software costs. As discussed fur-

ther below, we suspend depreciation and amortization on assets

related to restaurants that are held for disposal. Our deprecia-

tion and amortization expense was $319 million, $345 million

and $372 million in 2000, 1999 and 1998, respectively.

Intangible Assets

Intangible assets include both identifiable intangibles and

goodwill arising from the allocation of purchase prices of

businesses acquired. Where appropriate, intangible assets are

allocated to individual restaurants at the time of acquisition.

We base amounts assigned to identifiable intangibles on inde-

pendent appraisals or internal estimates. Goodwill represents

the residual purchase price after allocation to all identifiable

net assets. Our intangible assets are stated at historical allocated

cost less accumulated amortization and impairment write-

downs. We amortize intangible assets on a straight-line basis

as follows: up to 20 years for reacquired franchise rights, 3 to

34 years for trademarks and other identifiable intangibles and

up to 20 years for goodwill. As discussed further below, we

suspend amortization on intangible assets allocated to restau-

rants that are held for disposal. Our amortization expense was

$38 million, $44 million and $52 million in 2000, 1999

and 1998, respectively.

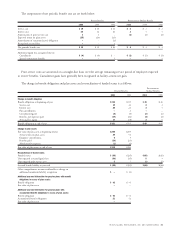

Franchise and License Fees

We execute franchise or license agreements for each point of

distribution which sets out the terms of our arrangement with

the franchisee or licensee. Our franchise and certain license

agreements require the franchisee or licensee to pay an initial,

non-refundable fee and continuing fees based upon a percent-

age of sales. Subject to our approval and payment of a renewal

fee, a franchisee may generally renew its agreement upon its

expiration. Our direct costs of the sales and servicing of

franchise and license agreements are charged to general and

administrative expenses as incurred.

We recognize initial fees as revenue when we have per-

formed substantially all initial services required by the franchise

or license agreement, which is generally upon opening of a

store. We recognize continuing fees as earned with an appro-

priate provision for estimated uncollectible amounts, which

is included in general and administrative expenses. We recog-

nize renewal fees in income when a renewal agreement becomes

effective. We include initial fees collected upon the sale of a

restaurant to a franchisee in refranchising gains (losses). Fees

for development rights are capitalized and amortized over

the life of the development agreement.

Refranchising Gains (Losses)

Refranchising gains (losses) includes the gains or losses from

the sales of our restaurants to new and existing franchisees

and the related initial franchise fees, reduced by transaction

costs and direct administrative costs of refranchising. In

executing our refranchising initiatives, we most often offer

groups of restaurants. We recognize gains on restaurant

refranchisings when the sale transaction closes, the franchisee

has a minimum amount of the purchase price in at-risk

equity and we are satisfied that the franchisee can meet its

financial obligations. Otherwise, we defer refranchising gains

until those criteria have been met. We only consider the

stores in the group “held for disposal” when the group is

expected to be sold at a loss. We recognize estimated losses

on restaurants to be refranchised and suspend depreciation

and amortization when: (a) we make a decision to refranchise

stores; (b) the estimated fair value less costs to sell is less than

the carrying amount of the stores; and (c) the stores can be

immediately removed from operations. When we make a

decision to retain a store previously held for refranchising, we

revalue the store at the lower of its net book value at our

original disposal decision date less normal depreciation and

amortization during the period held for disposal or its cur-

rent fair market value. This value becomes the store’s new

cost basis. We charge (or credit) any difference between the

store’s carrying amount and its new cost basis to refranchising

gains (losses). When we make a decision to close a store pre-

viously held for refranchising, we reverse any previously

recognized refranchising loss and then record the store closure

costs as described below. For groups of restaurants expected

to be sold at a gain, we typically do not suspend depreciation

and amortization until the sale is probable. For practical pur-

poses, we treat the closing date as the point at which the sale

is probable. Refranchising gains (losses) also include charges

for estimated exposures related to those partial guarantees of

franchisee loan pools and contingent lease liabilities which

arose from refranchising activities. These exposures are more

fully discussed in Note 21.

Store Closure Costs

Effective for closure decisions made on or subsequent

to April 23, 1998, we recognize the cost

of writing down the carrying amount of a

restaurant’s assets as store closure costs when

we have closed or replaced the restaurant

within the same quarter our decision

is made. Store closure

costs also include costs

of disposing of the assets

as well as other facility-

related expenses from