Pizza Hut 2000 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 45

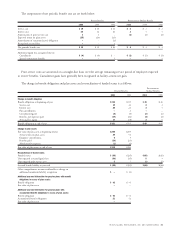

To the extent we participate in independent advertising coop-

eratives, we expense our contributions as incurred. At the end

of 2000 and 1999, we had deferred marketing costs of $8 mil-

lion and $3 million, respectively. Our advertising expenses

were $325 million, $385 million and $435 million in 2000,

1999 and 1998, respectively. The decline in our advertising

expense is primarily due to fewer Company stores as a result

of our refranchising program.

Research and Development Expenses

Research and development expenses, which we expense as

incurred, were $24 million in both 2000 and 1999 and $21

million in 1998.

Stock-Based Employee Compensation

We measure stock-based employee compensation cost for

financial statement purposes in accordance with Accounting

Principles Board Opinion No. 25, “Accounting for Stock

Issued to Employees,” and its related interpretations. We

include pro forma information in Note 15 as required by State-

ment of Financial Accounting Standards (“SFAS”) No. 123,

“Accounting for Stock-Based Compensation” (“SFAS 123”).

Accordingly, we measure compensation cost for the stock

option grants to the employees as the excess of the average

market price of the Common Stock at the grant date over

the amount the employee must pay for the stock. Our policy

is to generally grant stock options at the average market price

of the underlying Common Stock at the date of grant.

Derivative Instruments

As discussed in the New Accounting Pronouncement Not

Yet Adopted section which follows, we have not yet adopted

SFAS No. 133 “Accounting for Derivative Instruments and

Hedging Activities,” (“SFAS 133”) as of December 30, 2000.

In all years presented, our treatment of derivative instruments

is as follows.

We utilize interest rate swaps, collars and forward rate

agreements to hedge our exposure to fluctuations in interest

rates. We recognize the interest differential to be paid or

received on interest rate swap and forward rate agreements

as an adjustment to interest expense as the differential occurs.

We recognize the interest differential to be paid or received

on an interest rate collar as an adjustment to interest expense

when the interest rate falls below or rises above the collared

range. We reflect the recognized interest differential not yet

settled in cash in the accompanying Consolidated Balance

Sheets as a current receivable or payable. If we terminate an

interest rate swap, collar or forward rate position, any gain or

loss realized upon termination would be deferred and amortized

to interest expense over the remaining term of the underlying

debt instrument it was intended to modify or would be

recognized immediately if the underlying debt instrument

was settled prior to maturity.

Each period, we recognize in income foreign exchange

gains and losses on forward contracts that are designated

and effective as hedges of foreign currency receiv-

ables or payables as the differential occurs.

These gains or losses are largely offset by

the corresponding gain or loss recognized in

income on the currency translation of the receiv-

able or payable, as both amounts are based upon the

same exchange rates. We reflect the recognized foreign

currency differential for forward contracts not yet settled

in cash on the accompanying Consolidated Balance

Sheets each period as a current receivable or payable.

Each period, we recognize in income the change in fair

value of foreign exchange gains and losses on forward

contracts that are entered into to mitigate the

foreign exchange risk of certain forecasted

foreign currency denominated royalty

receipts. We reflect the fair value of

these forward contracts not yet settled

on the Consolidated Balance Sheets as

a current receivable or payable. If a foreign

currency forward contract is terminated prior to maturity,

the gain or loss recognized upon termination would be

immediately recognized in income.

We defer gains and losses on futures and options contracts

that are designated and effective as hedges of future commod-

ity purchases and include them in the cost of the related raw

materials when purchased. Changes in the value of futures

and options contracts that we use to hedge components of our

commodity purchases are highly correlated to changes in the

value of the purchased commodity attributable to the hedged

component. If the degree of correlation were to diminish such

that the two were no longer considered highly correlated, we

would immediately recognize subsequent changes in the value

of the futures and option contracts in income.

Cash and Cash Equivalents

Cash equivalents represent funds we have temporarily

invested (with original maturities not exceeding three months)

as part of managing our day-to-day operating cash receipts

and disbursements.

Inventories

We value our inventories at the lower of cost (computed on

the first-in, first-out method) or net realizable value.