Pizza Hut 2000 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES 67

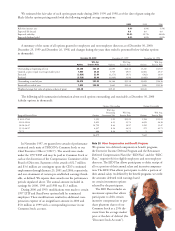

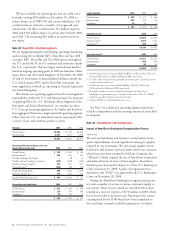

Fiscal Year Ended

(in millions, except per share and unit amounts) 2000 1999 1998 1997 1996

Summary of Operations

System sales(a)

U.S. $14,514 $14,516 $14,013 $13,502 $13,388

International 7,645 7,246 6,607 6,963 6,892

Total 22,159 21,762 20,620 20,465 20,280

Revenues

Company sales(b) 6,305 7,099 7,852 9,112 9,738

Franchise and license fees 788 723 627 578 494

Total 7,093 7,822 8,479 9,690 10,232

Facility actions net gain (loss)(c) 176 381 275 (247) 37

Unusual items(d) (204) (51) (15) (184) (246)

Operating profit 860 1,240 1,028 241 372

Interest expense, net 176 202 272 276 300

Income (loss) before income taxes 684 1,038 756 (35) 72

Net income (loss) 413 627 445 (111) (53))

Basic earnings per common share(e) 2.81 4.09 2 .92 N/A N/A

Diluted earnings per common share(e) 2.77 3.92 2.84 N/A N/A

Cash Flow Data

Provided by operating activities $÷÷«491 $«««««565 $«««««674 $«««««810 $«««««713

Capital spending 572 470 460 541 620

Proceeds from refranchising of restaurants 381 916 784 770 355

Balance Sheet

Total assets $÷4,149 $««3,961 $««4,531 $««5,114 $««6,520

Operating working capital deficit (634) (832) (960) (1,073) (915))

Long-term debt 2,397 2,391 3,436 4,551 231

Total debt 2,487 2,508 3,532 4,675 290

Investments by and advances from PepsiCo –– – – 4,266

Other Data

Number of stores at year end(a)

Company 6,123 6,981 8,397 10,117 11,876

Unconsolidated Affiliates 1,844 1,178 1,120 1,090 1,007

Franchisees 19,287 18,414 16,650 15,097 13,066

Licensees 3,163 3,409 3,596 3,408 3,147

System 30,417 29,982 29,763 29,712 29,096

U.S. Company same store sales growth(a)

KFC (3) % 2% 3% 2 % 6 %

Pizza Hut 1% 9% 6% (1) % (4) %

Taco Bell (5) % –3% 2 % (2) %

Blended (2) % 4% 4% 1 % N/A

Shares outstanding at year end (in millions) 147 151 153 152 N/A

Market price per share at year end $««33.00 $««37.94 $««47.63 $««28.31 N/A

N/A – Not Applicable.

TRICON Global Restaurants, Inc. and Subsidiaries (“TRICON”) became an independent, publicly owned company on October 6, 1997 through the spin-off of the

restaurant operations of its former parent, PepsiCo, Inc. (“PepsiCo”), to its shareholders. The historical consolidated financial data for 1997 and 1996 was prepared as if

we had been an independent, publicly owned company for those periods. To facilitate this presentation, PepsiCo made certain allocations of its previously unallocated inter-

est and general and administrative expenses as well as pro forma computations, to the extent possible, of separate income tax provisions for its restaurant segment. Fiscal

year 2000 includes 53 weeks. Fiscal years 1996 to 1999 include 52 weeks. The selected financial data should be read in conjunction with the Consolidated Financial

Statements and the Notes thereto.

(a) Excludes Non-core Businesses.

(b) Declining company sales are largely the result of our refranchising initiatives.

(c) 1999 and 1998 include $13 million ($10 million after-tax) and $54 million ($33 million after-tax), respectively, of favorable adjustments to our 1997 fourth

quarter charge which was $410 million ($300 million after-tax).

(d) See Note 5 to the Consolidated Financial Statements for a description of unusual items in 2000, 1999 and 1998. 1997 includes $120 million ($125 million

after-tax) related to our 1997 fourth quarter charge and an additional $54 million ($34 million after-tax) related to the 1997 disposal of the Non-core Businesses.

1996 includes a $246 million ($189 million after-tax) writedown of our Non-core Businesses. 1999 and 1998 included favorable adjustments to our 1997 fourth

quarter charge of $11 million ($10 million after-tax) and $11 million ($7 million after-tax), respectively.

(e) EPS data has been omitted for 1997 and 1996 as our capital structure as an independent, publicly owned company did not exist.

Selected Financial Data