Pizza Hut 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

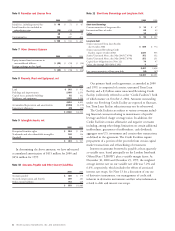

42 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES

(in millions) 2000 1999

ASSETS

Current Assets

Cash and cash equivalents $÷÷133 $÷÷÷89

Short-term investments, at cost 63 48

Accounts and notes receivable, less allowance: $82 in 2000 and $13 in 1999 302 161

Inventories 47 61

Prepaid expenses and other current assets 68 68

Deferred income tax assets 75 59

Total Current Assets 688 486

Property, Plant and Equipment, net 2,540 2,531

Intangible Assets, net 419 527

Investments in Unconsolidated Affiliates 257 170

Other Assets 245 247

Total Assets $«4,149 $«3,961

LIABILITIES AND SHAREHOLDERS’ DEFICIT

Current Liabilities

Accounts payable and other current liabilities $÷÷978 $«1,085

Income taxes payable 148 96

Short-term borrowings 90 117

Total Current Liabilities 1,216 1,298

Long-term Debt 2,397 2,391

Other Liabilities and Deferred Credits 848 825

Deferred Income Taxes 10 7

Total Liabilities 4,471 4,521

Shareholders’ Deficit

Preferred stock, no par value, 250 shares authorized; no shares issued ––

Common stock, no par value, 750 shares authorized; 147 and 151 shares issued

in 2000 and 1999, respectively 1,133 1,264

Accumulated deficit (1,278) (1,691)

Accumulated other comprehensive income (177) (133)

Total Shareholders’ Deficit (322) (560)

Total Liabilities and Shareholders’ Deficit $«4,149 $«3,961

See accompanying Notes to Consolidated Financial Statements.

Consolidated Balance Sheets

December 30, 2000 and December 25, 1999