Pitney Bowes 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

78

outstanding balances. See discussion on Pitney Bowes Bank below. As part of our transition initiatives, we recorded a charge of

$46.1 million in 2007 for the impairment of unguaranteed residual values which was included in the restructuring charges and asset

impairments line of the Consolidated Statement of Income. Also see Note 14 to the Consolidated Financial Statements for further

details.

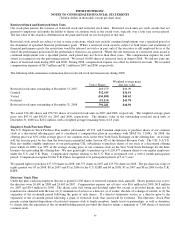

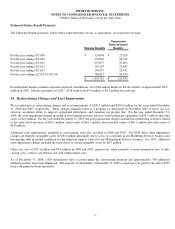

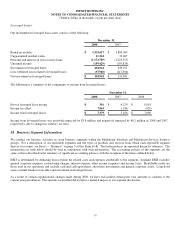

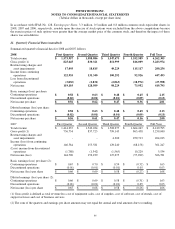

Maturities of gross finance receivables are as follows:

Years ending December 31,

2009 $ 1,677,044

2010 731,128

2011 499,862

2012 290,014

2013 122,074

Thereafter 18,677

Total $ 3,338,799

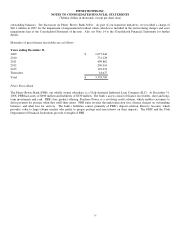

Pitney Bowes Bank

The Pitney Bowes Bank (PBB), our wholly owned subsidiary, is a Utah-chartered Industrial Loan Company (ILC). At December 31,

2008, PBB had assets of $690 million and liabilities of $630 million. The bank’s assets consist of finance receivables, short and long-

term investments and cash. PBB’s key product offering, Purchase Power, is a revolving credit solution, which enables customers to

defer payment for postage when they refill their meter. PBB earns revenue through transaction fees, finance charges on outstanding

balances, and other fees for services. The bank’s liabilities consist primarily of PBB’s deposit solution, Reserve Account, which

provides value to large-volume mailers who prefer to prepay postage and earn interest on their deposits. The FDIC and the Utah

Department of Financial Institutions provide oversight of PBB.