Pitney Bowes 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

and grow their customer relationships. We assigned the goodwill to the Marketing Services segment.

On April 19, 2007, we acquired MapInfo Corporation for $436 million in cash, net of cash acquired. Included in the assets and

liabilities acquired were short-term investments of $46 million and debt assumed of $14 million. MapInfo is a global company and a

leading provider of location intelligence software and solutions. We assigned the goodwill to the Software segment. As part of the

purchase accounting for MapInfo, we aligned MapInfo’s accounting policies for software revenue recognition with ours.

Accordingly, certain software revenue that was previously recognized by MapInfo on a periodic basis has now been recognized over

the life of the contract.

We accounted for these acquisitions using the purchase method of accounting and accordingly, the operating results of these

acquisitions have been included in our consolidated financial statements since the date of acquisition. Acquisitions made in 2008 did

not materially impact our diluted earnings per share for the year. As a result of the purchase accounting alignment, the acquisition of

MapInfo reduced our diluted earnings per share by 5 cents in 2007.

During 2008 and 2007, we also completed several smaller acquisitions, the costs of which were $29.7 million and $86.6 million,

respectively. These acquisitions did not have a material impact on our financial results. See Note 3 to the Consolidated Financial

Statements for further details.

Liquidity and Capital Resources

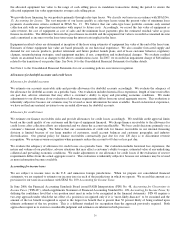

We believe that cash flow from operations, existing cash and liquid investments, as well as borrowing capacity under our commercial

paper program, the existing credit facility and debt capital markets should be sufficient to finance our capital requirements and to

cover our customer deposits. Our potential uses of cash include but are not limited to the following: growth and expansion

opportunities; internal investments; customer financing; tax payments; interest and dividend payments; share repurchase program;

pension and other benefit plan funding; and acquisitions.

In light of recent market events, we have conducted an extensive review of our liquidity provisions. We have carefully monitored for

material changes in the creditworthiness of those banks acting as derivative counterparties, depository banks or credit providers to us

through credit ratings and the credit default swap market. We have determined that there has not been a material variation in the

underlying sources of cash flows currently used to finance the operations of the company. To date, we have had consistent access to

the commercial paper market.

Cash Flow Summary

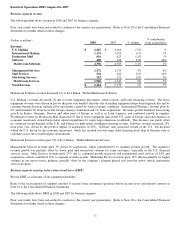

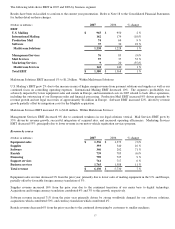

The change in cash and cash equivalents is as follows:

(Dollars in millions)

2008 2007

Cash provided by operating activities $ 990 $ 1,060

Cash used in investing activities (234) (726)

Cash used in financing activities (742) (204)

Effect of exchange rate changes on cash (15) 8

(Decrease) increase in cash and cash equivalents $ (1) $ 138

2008 Cash Flows

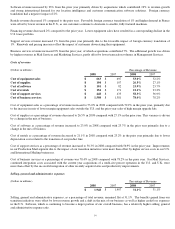

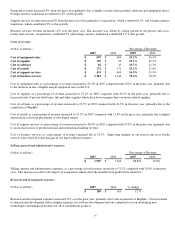

Net cash provided by operations consisted primarily of net income adjusted for non-cash items and changes in operating assets and

liabilities. The strong cash flow provided by operations for 2008 is primarily due to the timing of tax payments, which favorably

contributed $122 million, and the receipt of $44 million related to the unwind of an interest rate swap, which is described in further

detail in Note 8 to the Consolidated Financial Statements. Partially offsetting these positive impacts was a reduction in accounts

payable and accrued liabilities of $77 million, primarily due to timing of these payments.

Net cash used in investing activities consisted of capital expenditures of $237 million primarily for rental assets and acquisitions of

$68 million partially offset by proceeds from short-term and other investments of $36 million, and increased reserve account balances

for customer deposits of $33 million.

Net cash used in financing activities was $742 million and consisted primarily of stock repurchases of $333 million, dividends paid of

$292 million, and a net payment of debt of $125 million, which was partly offset by proceeds of $20 million from the issuance of