Pitney Bowes 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

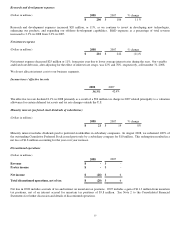

Restructuring Charges and Asset Impairments

We recorded pre-tax restructuring charges and asset impairments of $200.3 million and $264.0 million for the years ended December

31, 2008 and 2007, respectively. These charges primarily relate to a program we announced in November 2007 to lower our cost

structure, accelerate efforts to improve operational efficiencies, and transition our product line. For the year ended December 31,

2008, the asset impairment charges included in restructuring activities relate to older technology equipment of $28.5 million and other

assets of $2.2 million. For the year ended December 31, 2007, the asset impairment charges included in restructuring activities related

to the write-off of inventory of $48.1 million, rental assets of $61.5 million, lease residual values of $46.1 million and other assets of

$8.8 million.

Additional asset impairments, unrelated to restructuring, were also recorded in 2008 and 2007. For 2008, these other impairment

charges are related to intangible assets of $16.0 million principally due to a loss of a customer in our Marketing Services business and

the ongoing shift in market conditions for the litigation support vertical in our Management Services business. For 2007, additional

asset impairment charges included the write-down of certain intangible assets for $8.5 million.

Other exit costs of $35.3 million and $5.8 million in 2008 and 2007, respectively, relate primarily to lease termination fees, facility

closing costs, contract cancellation costs and outplacement costs.

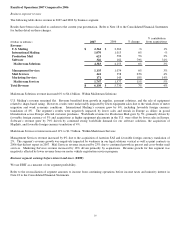

As of December 31, 2008, 1,926 terminations have occurred under the restructuring program and approximately 300 additional

unfilled positions have been eliminated. The majority of the liability at December 31, 2008 is expected to be paid by the end of 2009

from cash generated from operations.

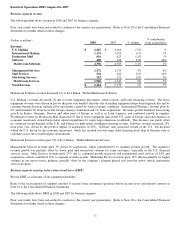

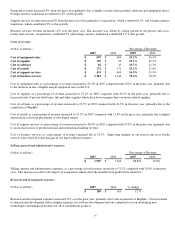

The pre-tax restructuring charges and asset impairments are composed of:

(Dollars in millions) Balance at

December 31, 2007

2008 Expense Cash payments Non-cash

Charges Balance at

December 31, 2008

Severance and benefit costs $ 81 $ 118 $ (91) $ - $ 108

Asset impairments - 47 - (47) -

Other exit costs 6 35 (8) - 33

Total $ 87 $ 200 $ (99) $ (47) $ 141

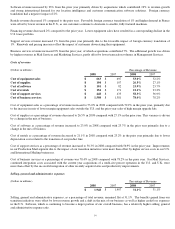

(Dollars in millions) Balance at

December 31, 2006

2007 Expense Cash payments Non-cash

Charges Balance at

December 31, 2007

Severance and benefit costs $ - $ 85 $ (4) $ - $ 81

Asset impairments - 173 - (173) -

Other exit costs - 6 - - 6

Total $ - $ 264 $ (4) $ (173) $ 87

In January 2003, we undertook restructuring initiatives related to realigned infrastructure requirements and reduced manufacturing

needs for digital equipment. In connection with this plan, we recorded pre-tax restructuring charges of $36 million for the year ended

December 31, 2006. The program was completed during 2006 and, therefore, there were no additional restructuring charges related to

this plan after December 31, 2006. We made restructuring payments of $3 million, $29 million and $51 million during 2008, 2007

and 2006, respectively. See Note 1 to the Consolidated Financial Statements for our accounting policy related to restructuring charges

and asset impairments.

Acquisitions

On April 21, 2008, we acquired Zipsort, Inc. for $39 million in cash, net of cash acquired. Zipsort, Inc. acts as an intermediary

between customers and the U.S. Postal Service. Zipsort, Inc. offers mailing services that include presorting of first class, standard

class, flats, permit and international mail as well as metering services. We assigned the goodwill to the Mail Services segment.

On September 12, 2007, we acquired Asterion SAS for $29 million in cash, net of cash acquired. Asterion is a leading provider of

outsourced transactional print and document process services in France. We assigned the goodwill to the Management Services

segment.

On May 31, 2007, we acquired the remaining shares of Digital Cement, Inc. for a total purchase price of $52 million in cash, net of

cash acquired. Digital Cement, Inc. provides marketing management strategy and services to help companies acquire, retain, manage,