Pitney Bowes 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

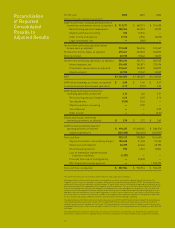

Summary of

Selected

Financial Data

increase in R&D expenditures to bring new solutions to market. In total, we

expect the program to generate more than $200 million in annualized savings.

Our commitment to delivering shareholder value is refl ected in the way

we used our cash to deliver returns to shareholders. During the year we

returned $625 million to our shareholders through $292 million in dividends

and $333 million in share repurchases.

We were also pleased to provide a 3 percent increase in our dividend,

to $0.36 per common share, for the fi rst quarter of 2009. Because of

our attractive dividend yield and increased adjusted earnings per share,

our total return to shareholders in 2008 outpaced the S&P 500 index by

7 percentage points.

With a lowered cost structure, enhanced operating effi ciency and

stronger liquidity, we are better positioned to successfully navigate an

uncertain environment today than we were one year ago.

We remain committed to disciplined action to maximize shareholder

return and deliver sustained value in 2009 and beyond.

Michael Monahan

Executive Vice President and

Chief Financial Offi cer

Financial Highlights

from Our CFO

For the year 2008 2007 2006

(Dollars in thousands, except per share amounts)

As Reported

Revenue $ 6,262,305 $ 6,129,795 $ 5,730,018

Income from continuing operations $ 447,493 $ 361,247 $ 565,659

Diluted earnings per share from

continuing operations $ 2.13 $ 1.63 $ 2.51

Cash provided by (used in)

operating activities $ 990,437 $ 1,060,465 $ (286,574)

Depreciation and amortization $ 379,117 $ 383,141 $ 363,258

Capital expenditures $ 237,308 $ 264,656 $ 327,877

Cash dividends per share of common stock $ 1.40 $ 1.32 $ 1.28

Average common and potential common

shares outstanding 209,699,471 221,219,746 225,443,060

Total assets $ 8,736,431 $ 9,465,731 $ 8,527,331

Total debt $ 4,705,366 $ 4,755,842 $ 4,338,157

Stockholders’ equity $ (187,879) $ 660,169 $ 716,055

Total employees $ 35,140 $ 36,165 $ 34,454

As Adjusted

EBIT $ 1,136,085 $ 1,186,097 $ 1,160,063

Income from continuing operations $ 583,233

$ 601,114 $ 606,765

Diluted earnings per share from

continuing operations $ 2.78 $ 2.72 $ 2.69

Free cash fl ow $ 887,984 $ 923,914 $ 523,439

EBIT to interest 5.2 4.9 5.5