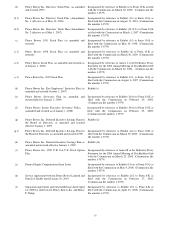

Pitney Bowes 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 30

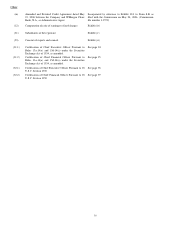

Forward-Looking Statements

We want to caution readers that any forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934 in this Form 10-K, other reports or press releases or made by our management

involve risks and uncertainties which may change based on various important factors. We undertake no obligation to publicly update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking

statements are those which talk about our current expectations as to the future and include, but are not limited to, statements about the

amounts, timing and results of possible restructuring charges and future earnings. Words such as “estimate,” “project,” “plan,”

“believe,” “expect,” “anticipate,” “intend,” and similar expressions may identify such forward-looking statements. Some of the

factors which could cause future financial performance to differ materially from the expectations as expressed in any forward-looking

statement made by or on our behalf include:

• changes in international or national political conditions, including any terrorist attacks

• negative developments in economic conditions, including adverse impacts on customer demand

• changes in postal regulations

• timely development and acceptance of new products

• success in gaining product approval in new markets where regulatory approval is required

• successful entry into new markets

• mailers’ utilization of alternative means of communication or competitors’ products

• our success at managing customer credit risk

• our success at managing costs associated with our strategy of outsourcing functions and operations not central to our business

• changes in interest rates

• foreign currency fluctuations

• cost, timing and execution of our transition plans including any potential asset impairments

• regulatory approvals and satisfaction of other conditions to consummation of any acquisitions and integration of recent

acquisitions

• interrupted use of key information systems

• changes in privacy laws

• intellectual property infringement claims

• impact on mail volume resulting from current concerns over the use of the mail for transmitting harmful biological agents

• third-party suppliers’ ability to provide product components, assemblies or inventories

• negative income tax adjustments for prior audit years and changes in tax laws or regulations

• changes in pension and retiree medical costs

• acts of nature

ITEM 7A. – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

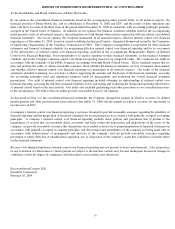

We are exposed to the impact of interest rate changes and foreign currency fluctuations due to our investing and funding activities and

our operations denominated in different foreign currencies.

We manage our exposure to changes in interest rates by limiting its impact on earnings and cash flows and lowering our overall

borrowing costs. We use a balanced mix of debt maturities and variable and fixed rate debt together with interest rate swaps to

execute our strategy.

Our objective in managing our exposure to foreign currency fluctuations is to reduce the volatility in earnings and cash flows

associated with the effect of foreign exchange rate changes on transactions that are denominated in foreign currencies. Accordingly,

we enter into various contracts, which change in value as foreign exchange rates change, to protect the value of external and

intercompany transactions. The principal currencies actively hedged are the British pound, Canadian dollar and Euro.

We employ established policies and procedures governing the use of financial instruments to manage our exposure to such risks. We

do not enter into foreign currency or interest rate transactions for speculative purposes. The gains and losses on these contracts offset

changes in the value of the related exposures.

We utilize a “Value-at-Risk” (VaR) model to determine the maximum potential loss in fair value from changes in market conditions.

The VaR model utilizes a “variance/co-variance” approach and assumes normal market conditions, a 95% confidence level and a one-

day holding period. The model includes all of our debt and all interest rate and foreign exchange derivative contracts. The model