Pitney Bowes 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 28

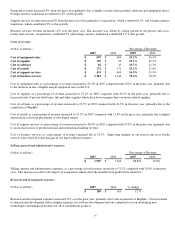

should lead to greater consistency between the useful life of recognized intangibles under SFAS 142 and the period of expected cash

flows used to measure fair value of such assets under SFAS No. 141(R), Business Combinations. FSP FAS 142-3 will be applied

prospectively beginning January 1, 2009. We do not expect the adoption of this Statement to have a material impact on our financial

position, results of operations, or cash flows.

In May 2008, the FASB issued SFAS No. 162, The Hierarchy of Generally Accepted Accounting Principles (“SFAS 162”). SFAS

162 identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of

financial statements of nongovernmental entities that are presented in conformity with U.S. GAAP. SFAS 162 is effective for fiscal

years beginning after November 15, 2008. The adoption of this Statement did not result in a change in current practice.

In September 2008, the FASB issued FSP FAS 133-1 and FASB Interpretation (FIN) No. 45-4, Disclosures about Credit Derivatives

and Certain Guarantees: An Amendment of FASB Statement No. 133 and FASB Interpretation No. 45; and Clarification of the

Effective Date of FASB Statement No. 161. The FSP amends SFAS No. 133 to require a seller of credit derivatives, including credit

derivatives embedded in a hybrid instrument, to provide certain disclosures for each statement of financial position presented. These

disclosures are required even if the likelihood of having to make payments is remote. To make the disclosures consistent with the

disclosures that will now be required for credit derivatives, FIN No. 45-4 was issued to require guarantors to disclose the current status

of the payment/performance risk of the guarantee. This FSP also clarifies that SFAS 161 is effective for financial statements issued

for fiscal years and interim periods beginning after November 15, 2008. The FSP is effective for reporting periods ending after

November 15, 2008. The Company does not sell credit derivatives. The Company has complied with the additional disclosure

requirement for guarantees in the fourth quarter of 2008.

In December 2008, the FASB issued FSP FAS 132(R)-1, Employers’ Disclosures about Postretirement Benefit Plan Assets, which

amends Statement No. 132(R) to require more detailed disclosures about employer’s plan assets, including investment strategies,

major categories of assets, concentrations of risk within plan assets and valuation techniques used to measure the fair value of assets.

The FSP is effective for fiscal years ending after December 15, 2009. The Company will comply with the additional disclosure

requirements.

Legal and Regulatory Matters

Legal

See Legal Proceedings in Item 3 of this Form 10-K for information regarding our legal proceedings.

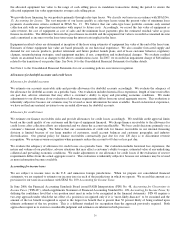

Income taxes

We regularly assess the likelihood of tax adjustments in each of the tax jurisdictions in which we have operations and account for the

related financial statement implications. Tax reserves have been established which we believe to be appropriate given the possibility

of tax adjustments. Determining the appropriate level of tax reserves requires us to exercise judgment regarding the uncertain

application of tax law. The amount of reserves is adjusted when information becomes available or when an event occurs indicating a

change in the reserves is appropriate. Future changes in tax reserve requirements could have a material impact on our results of

operations.

We are continually under examination by tax authorities in the United States, other countries and local jurisdictions in which we have

operations. The years under examination vary by jurisdiction. The current IRS exam of tax years 2001-2004 is estimated to be

completed within the next two years. In connection with this exam, we have recently received notices of proposed adjustments to our

filed returns. We have accrued our best estimate of the tax, interest and penalties that may result from these proposed adjustments in

accordance with FIN 48. We are disputing a formal request from the IRS in the form of a civil summons to provide certain company

workpapers. We believe that certain documents being sought should not be produced because they are privileged. In a similar case,

the U.S. Court of Appeals for the First Circuit ruled that certain company workpapers were privileged, however, the case was

remanded to the lower court to consider other related issues. Also in connection with the 2001-2004 audits, we have entered into a

settlement with the IRS regarding the tax treatment of certain lease transactions related to the Capital Services business that we sold in

2006. Prior to 2007, we accrued and paid the IRS the additional tax and interest associated with this settlement. A variety of post-

1999 tax years remain subject to examination by other tax authorities, including the U.K., Canada, France, Germany and various U.S.

states. We have accrued our best estimate of the tax, interest and penalties that may result from these tax uncertainties in these and

other jurisdictions in accordance with FIN 48. However, the resolution of such matters could have a material impact on our results of

operations, financial position and cash flows.

In August 2006, we reached a settlement with the IRS governing all outstanding tax audit issues in dispute for the tax years through

2000. Accordingly, in 2006 we recorded $61 million of additional tax expense. Of the $61 million, $41 million related to the Capital

Services business and was included in discontinued operations and $20 million was included in continuing operations. The federal