Pitney Bowes 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

75

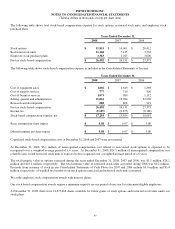

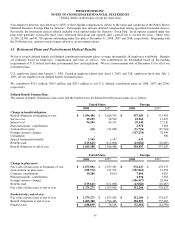

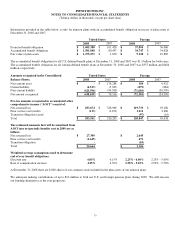

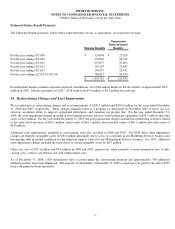

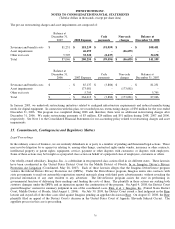

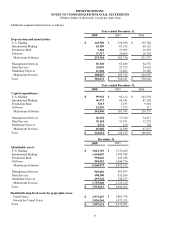

Estimated Future Benefit Payments

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

Pension Benefits

Nonpension

Postretirement

Benefits

For the year ending 12/31/09 $ 124,606 $ 27,029

For the year ending 12/31/10 132,096 26,574

For the year ending 12/31/11 135,077 25,403

For the year ending 12/31/12 143,143 23,983

For the year ending 12/31/13 146,973 22,431

For the years ending 12/31/14-12/31/18 788,815 96,456

$ 1,470,710 $ 221,876

Postretirement benefit payments represent expected contributions, net of the annual Medicare Part D subsidy of approximately $2.8

million in 2009. Subsidy payments for 2010 – 2018 range from $3.0 million to $4.2 million for each year.

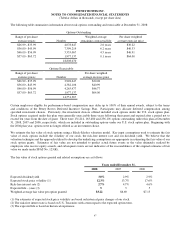

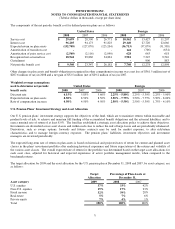

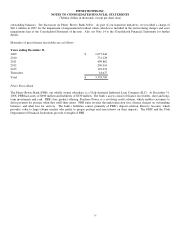

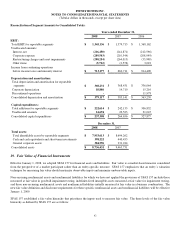

14. Restructuring Charges and Asset Impairments

We recorded pre-tax restructuring charges and asset impairments of $200.3 million and $264.0 million for the years ended December

31, 2008 and 2007, respectively. These charges primarily relate to a program we announced in November 2007 to lower our cost

structure, accelerate efforts to improve operational efficiencies, and transition our product line. For the year ended December 31,

2008, the asset impairment charges included in restructuring activities relate to older technology equipment of $28.5 million and other

assets of $2.2 million. For the year ended December 31, 2007, the asset impairment charges included in restructuring activities related

to the write-off of inventory of $48.1 million, rental assets of $61.5 million, lease residual values of $46.1 million and other assets of

$8.8 million.

Additional asset impairments, unrelated to restructuring, were also recorded in 2008 and 2007. For 2008, these other impairment

charges are related to intangible assets of $16.0 million principally due to a loss of a customer in our Marketing Services business and

the ongoing shift in market conditions for the litigation support vertical in our Management Services business. For 2007, additional

asset impairment charges included the write-down of certain intangible assets for $8.5 million.

Other exit costs of $35.3 million and $5.8 million in 2008 and 2007, respectively, relate primarily to lease termination fees, facility

closing costs, contract cancellation costs and outplacement costs.

As of December 31, 2008, 1,926 terminations have occurred under the restructuring program and approximately 300 additional

unfilled positions have been eliminated. The majority of the liability at December 31, 2008 is expected to be paid by the end of 2009

from cash generated from operations.