Pitney Bowes 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

83

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities. Examples of Level 1 assets include

money market securities and U.S. Treasury securities.

Level 2 – Observable inputs other than Level 1 inputs such as quoted prices for similar assets or liabilities; quoted prices in

markets that trade infrequently; or other inputs that are observable or can be corroborated by observable market data for substantially

the full term of the assets or liabilities. Examples of Level 2 assets and liabilities include derivative contracts whose values are

determined using a model with inputs that are observable in the market or can be derived from or corroborated by observable market

data, mortgage-backed securities, asset backed securities, U.S. agency securities, and corporate notes and bonds.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the

asset or liability. These inputs may be derived with internally developed methodologies that result in management’s best estimate of

fair value. During the twelve months ended December 31, 2008 we had no Level 3 recurring measurements.

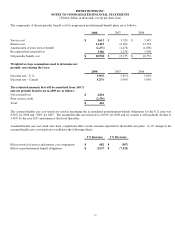

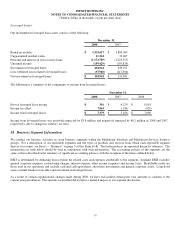

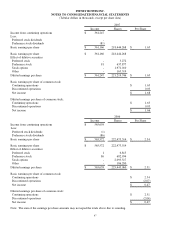

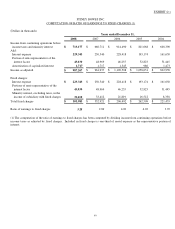

The following table shows, by level within the fair value hierarchy, our financial assets and liabilities that are accounted for at fair

value on a recurring basis at December 31, 2008. As required by SFAS 157, financial assets and liabilities are classified in their

entirety based on the lowest level of input that is significant to the fair value measurement. Our assessment of the significance of a

particular input to the fair value measurement requires judgment and may affect their placement within the fair value hierarchy levels.

Recurring Fair Value Measurements at December 31, 2008 by Level

Level 1 Level 2 Level 3 Total

Assets:

Investment securities

Money market funds $ 181,664 $ - $ - $ 181,664

U.S. Government and agency issued debt 30,583 11,433 - 42,016

Corporate notes and bonds - 4,725 - 4,725

Asset backed securities - 2,658 - 2,658

Mortgage-backed securities - 21,713 - 21,713

Derivatives

Interest rate swaps - 32,486 - 32,486

Total assets $ 212,247 $ 73,015 $ - $ 285,262

Liabilities:

Derivatives

Foreign exchange contracts $ - $ (286) $ - $ (286)

Treasury lock and forward starting swaps - (31,326) - (31,326)

Total liabilities $ - $ (31,612) $ - $ (31,612)

Investment Securities

For our investments, we use the market approach for recurring fair value measurements and the valuation techniques use inputs that

are observable, or can be corroborated by observable data, in an active marketplace.

The following information relates to our classification into the fair value hierarchy:

● Money Market Funds: Money market funds typically invest in government securities, certificates of deposit, commercial paper

of companies and other highly liquid and low-risk securities. Money market funds are principally used for overnight deposits and are

classified in Level 1 of the fair value hierarchy.

● U.S. Government Issued Debts: U.S. Governmental securities are valued using active, high volume trades for identical securities.

Valuation adjustments are not applied so these securities are classified in Level 1 of the fair value hierarchy.