Pitney Bowes 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

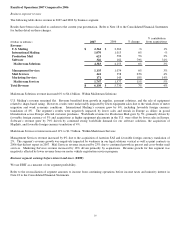

Net interest expense

(Dollars in millions) 2007 2006 % change

$ 242 $ 213 14%

Net interest expense increased 14% in 2007 due to higher average interest rates and higher average borrowings during the year. Also,

in 2006 we had interest income on the cash balance that resulted from the Capital Services divestiture. Our variable and fixed rate

debt mix, after adjusting for the effect of interest rate swaps, was 19% and 81%, respectively, at December 31, 2007.

We do not allocate interest costs to our business segments.

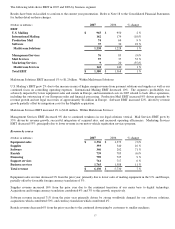

Income taxes / effective tax rate

2007 2006

42.4% 36.6%

The effective tax rate for continuing operations for 2007 included $54 million of tax charges related principally to a valuation

allowance for certain deferred tax assets and tax rate changes outside the U.S. The effective tax rate for 2006 included a $20 million

charge related to the IRS settlement discussed in Note 9 to the Consolidated Financial Statements.

Minority interest (preferred stock dividends of subsidiaries)

(Dollars in millions)

2007 2006 % change

$ 19 $ 14 39%

Minority interest includes dividends paid to preferred stockholders in subsidiary companies. Minority interest increased by $5

million compared with the prior year, primarily due to an increase in the average outstanding preferred shares and a higher weighted

average dividend rate.

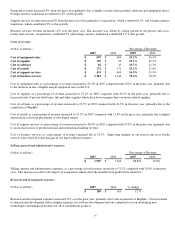

Discontinued operations

(Dollars in millions)

2007 2006

Revenue $ - $ 81

Pretax income $ - $ 29

Net income $ 6 $ 31

Gain on sale of Imagistics, net of $7 tax expense - 11

FSC tax law change - (16)

Additional tax on IRS settlement - (41)

Loss on sale of Capital Services, net of $285 tax benefit - (445)

Total discontinued operations, net of tax $ 6 $ (460)

Net income in 2007 includes a gain of $11.3 million from the conclusion of certain tax issues net of an interest accrual for uncertain

tax positions of $5.8 million. In 2006, we completed the sale of our Capital Services external financing business and our Imagistics

lease portfolio. See Note 2 to the Consolidated Financial Statements for further discussion and details of discontinued operations.

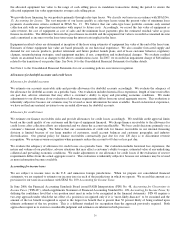

Other (Income) Expense

In 2007 and 2006, we recorded pre-tax gains of approximately $3 million and $5 million, respectively, related to a revised liability

estimate associated with the settlement of a previous lawsuit and net pre-tax charges of approximately $3 million in 2007 and $2

million in 2006 for other legal matters. These amounts are included in other (income) expense in the Consolidated Statements of

Income.