Pitney Bowes 2008 Annual Report Download - page 70

Download and view the complete annual report

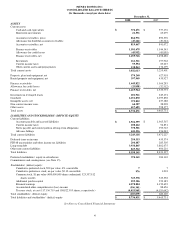

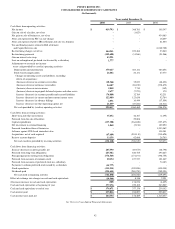

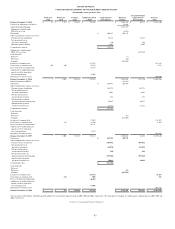

Please find page 70 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

51

In May 2008, the FASB issued SFAS No. 162, The Hierarchy of Generally Accepted Accounting Principles (“SFAS 162”). SFAS

162 identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of

financial statements of nongovernmental entities that are presented in conformity with U.S. GAAP. SFAS 162 is effective for fiscal

years beginning after November 15, 2008. The adoption of this Statement did not result in a change in current practice.

In September 2008, the FASB issued FSP FAS 133-1 and FASB Interpretation (FIN) No. 45-4, Disclosures about Credit Derivatives

and Certain Guarantees: An Amendment of FASB Statement No. 133 and FASB Interpretation No. 45; and Clarification of the

Effective Date of FASB Statement No. 161. The FSP amends SFAS No. 133 to require a seller of credit derivatives, including credit

derivatives embedded in a hybrid instrument, to provide certain disclosures for each statement of financial position presented. These

disclosures are required even if the likelihood of having to make payments is remote. To make the disclosures consistent with the

disclosures that will now be required for credit derivatives, FIN No. 45-4 was issued to require guarantors to disclose the current status

of the payment/performance risk of the guarantee. This FSP also clarifies that SFAS 161 is effective for financial statements issued

for fiscal years and interim periods beginning after November 15, 2008. The FSP is effective for reporting periods ending after

November 15, 2008. The Company does not sell credit derivatives. The Company has complied with the additional disclosure

requirement for guarantees in the fourth quarter of 2008.

In December 2008, the FASB issued FSP FAS 132(R)-1, Employers’ Disclosures about Postretirement Benefit Plan Assets, which

amends Statement No. 132(R) to require more detailed disclosures about employer’s plan assets, including investment strategies,

major categories of assets, concentrations of risk within plan assets and valuation techniques used to measure the fair value of assets.

The FSP is effective for fiscal years ending after December 15, 2009. The Company will comply with the additional disclosure

requirements.

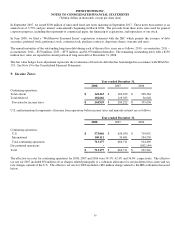

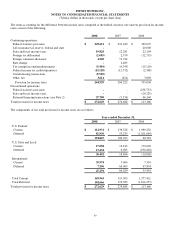

2. Discontinued Operations

On May 1, 2006, we completed the sale of our Imagistics lease portfolio to De Lage Landen Operational Services, LLC, a subsidiary

of Rabobank Group, for approximately $288 million. Net proceeds on the sale were approximately $282 million after transaction

expenses. We reported the results of the Imagistics lease portfolio in discontinued operations including an after-tax gain of

approximately $11 million from the sale of this portfolio.

On July 14, 2006, we completed the sale of our Capital Services external financing business to Cerberus Capital Management, L.P.

(Cerberus) for approximately $747 million and the assumption of approximately $470 million of non-recourse debt and other

liabilities. This sale resulted in the disposition of most of the external financing activity in the Capital Services segment. The

proceeds received at closing were used to pay our tax obligations. We reported the results of the Capital Services business in

discontinued operations, including an after-tax loss of $445 million from the sale of this business. We retained certain leveraged

leases in Canada which are included in our International Mailing segment.

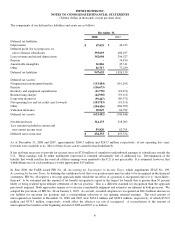

In August 2006, we reached a settlement with the Internal Revenue Service (IRS) on all outstanding tax audit issues in dispute for tax

years through 2000. Years after 2000 are still under review by the IRS. In connection with the settlement, we recorded $61 million of

additional tax expense of which $41 million was included in discontinued operations. See Note 9 for further discussion of the IRS

settlement.

In 2006, we accrued in discontinued operations an additional tax expense of $16 million to record the impact of the Tax Increase

Prevention and Reconciliation Act (TIPRA). The TIPRA legislation repealed the exclusion from federal income taxation of a portion

of the income generated from certain leveraged leases of aircraft by foreign sales corporations (FSC).

In December 2006, we sold our bankruptcy claim related to certain aircraft leases with Delta Airlines. We received proceeds of $14.5

million, which represent a contingent gain pending the bankruptcy court decision. Given the continued uncertainty and inability to

anticipate the outcome of the bankruptcy court decision, we have not recognized any portion of this contingent gain in our

consolidated income statement.