Pitney Bowes 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

58

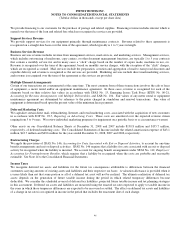

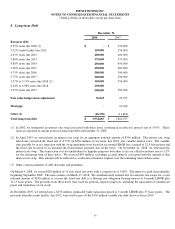

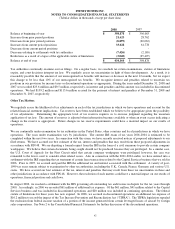

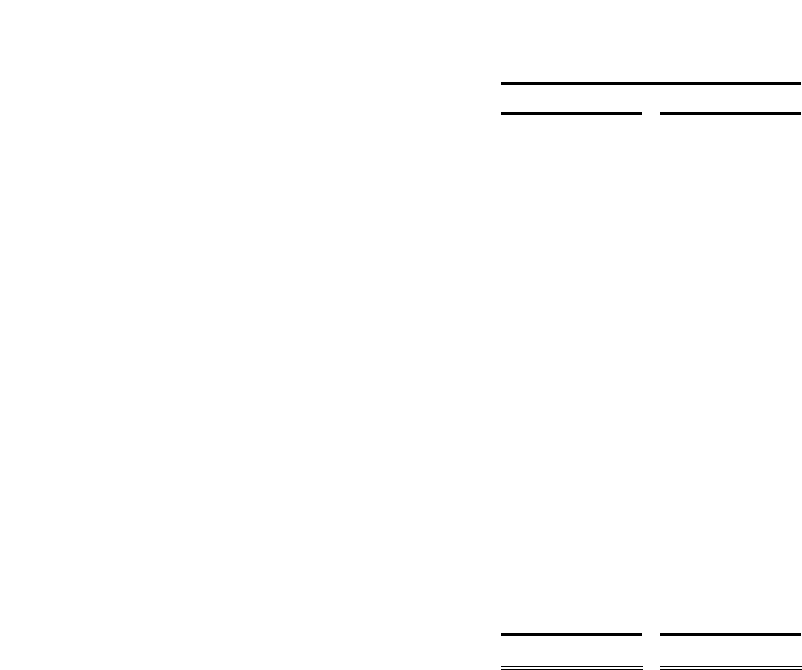

8. Long-term Debt

December 31,

2008 2007

Recourse debt

8.55% notes due 2009 (1) $ - $ 150,000

5.32% credit facility due 2012 150,000 150,000

4.63% notes due 2012 400,000 400,000

3.88% notes due 2013 375,000 375,000

4.88% notes due 2014 450,000 450,000

5.00% notes due 2015 400,000 400,000

4.75% notes due 2016 500,000 500,000

5.75% notes due 2017 500,000 500,000

2.37% to 5.13% notes due 2018 (2) 350,000 350,000

2.24% to 4.98% notes due 2018 250,000 -

5.25% notes due 2037 500,000 500,000

Fair value hedges basis adjustment 76,043 25,753

Mortgage - 13,186

Other (3) (16,178) (11,864)

Total long-term debt $ 3,934,865 $ 3,802,075

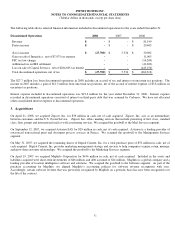

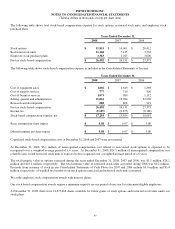

(1) In 2002, we terminated an interest rate swap associated with these notes, resulting in an effective interest rate of 5.05%. These

notes are reported in current portion of long-term debt at December 31, 2008.

(2) In April 2003, we entered into an interest rate swap for an aggregate notional amount of $350 million. The interest rate swap

effectively converted the fixed rate of 4.75% on $350 million of our notes, due 2018, into variable interest rates. The variable

rates payable by us in connection with the swap agreement were based on six month LIBOR less a spread of 22.8 basis points and

the fixed rate received by us matched the fixed interest payment due on the notes. On November 21, 2008, we unwound this

interest rate swap. This transaction was not undertaken for liquidity purposes but rather to fix our effective interest rate to 3.2%

for the remaining term of these notes. We received $44 million, excluding accrued interest, associated with the unwind of this

interest rate swap. This amount will be reflected as a reduction of interest expense over the remaining term of these notes.

(3) Other consists primarily of debt discounts and premiums.

On March 4, 2008, we issued $250 million of 10 year fixed rate notes with a coupon rate of 5.60%. The interest is paid semi-annually

beginning September 2008. The notes mature on March 15, 2018. We simultaneously entered into two interest rate swaps for a total

notional amount of $250 million to convert the fixed rate debt to a floating rate obligation bearing interest at 6 month LIBOR plus

111.5 basis points. The proceeds from these notes were used for general corporate purposes, including the repayment of commercial

paper and repurchase of our stock.

In December 2007, we entered into a $150 million syndicated bank transaction priced at 3 month LIBOR plus 35 basis points. The

proceeds from this credit facility, due 2012, were used to pay off the $150 million variable rate debt that was due in 2010.