Pitney Bowes 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

71

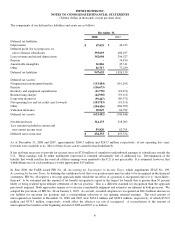

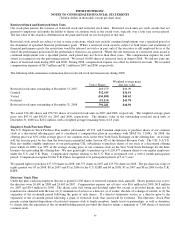

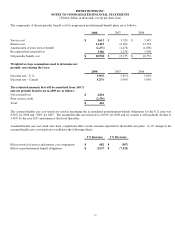

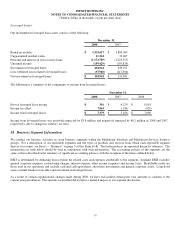

The components of the net periodic benefit cost for defined pension plans are as follows:

United States Foreign

2008 2007 2006 2008 2007 2006

Service cost $ 29,699 $ 28,500 $ 26,771 $ 10,562 $ 13,427 $ 11,207

Interest cost 96,205 94,173 91,823 29,140 27,720 22,666

Expected return on plan assets (132,748) (127,070) (125,204) (36,713) (37,079) (31,338)

Amortization of transition cost - - - 142 (706) (654)

Amortization of prior service cost (2,560) (2,116) (2,090) 628 663 618

Recognized net actuarial loss 18,944 29,860 34,881 3,981 7,347 9,516

Curtailment - - - - 906 883

Net periodic benefit cost $ 9,540 $ 23,347 $ 26,181 $ 7,740 $ 12,278 $ 12,898

Other changes in plan assets and benefit obligations recognized in other comprehensive income was a net loss of $361.5 million (net o

f

$207.6 million of tax) in 2008 and a net gain of $52.5 million (net of $29.2 million of tax) in 2007.

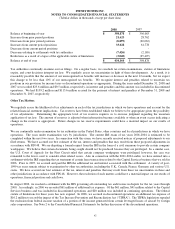

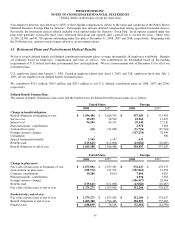

Weighted average assumptions

used to determine net periodic United States Foreign

benefit costs: 2008 2007 2006 2008 2007 2006

Discount rate 6.15% 5.85% 5.60% 2.25% - 5.80% 2.25% - 5.30% 2.25% - 5.00%

Expected return on plan assets 8.50% 8.50% 8.50% 3.50% - 7.75% 3.50% - 7.75% 3.50% - 8.00%

Rate of compensation increase 4.50% 4.50% 4.50% 2.50% - 5.50% 2.50% - 5.30% 1.75% - 4.10%

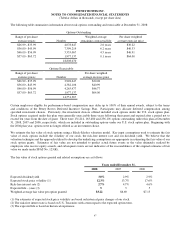

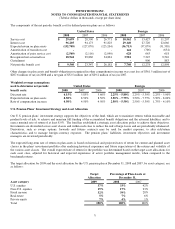

U.S. Pension Plans’ Investment Strategy and Asset Allocation

Our U.S. pension plans’ investment strategy supports the objectives of the fund, which are to maximize returns within reasonable and

prudent levels of risk, to achieve and maintain full funding of the accumulated benefit obligations and the actuarial liabilities, and to

earn a nominal rate of return of at least 8.0%. The fund has established a strategic asset allocation policy to achieve these objectives.

Investments are diversified across asset classes and within each class to reduce the risk of large losses and are periodically rebalanced.

Derivatives, such as swaps, options, forwards and futures contracts may be used for market exposure, to alter risk/return

characteristics and to manage foreign currency exposure. The pension plans’ liabilities, investment objectives and investment

managers are reviewed periodically.

The expected long-term rate of return on plan assets is based on historical and projected rates of return for current and planned asset

classes in the plans’ investment portfolio after analyzing historical experience and future expectations of the returns and volatility of

the various asset classes. The overall expected rate of return for the portfolio was determined based on the target asset allocations for

each asset class, adjusted for historical and expected experience of active portfolio management results, when compared to the

benchmark returns.

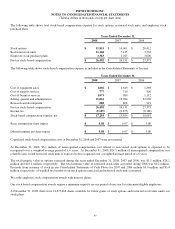

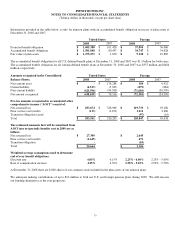

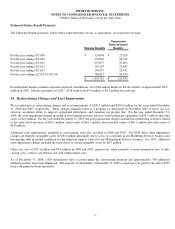

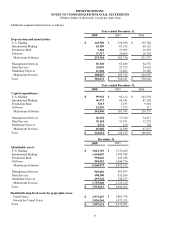

The target allocation for 2009 and the asset allocation for the U.S. pension plan at December 31, 2008 and 2007, by asset category, are

as follows:

Target

Allocation Percentage of Plan Assets at

December 31,

Asset category 2009 2008 2007

U.S. equities 37% 33% 42%

Non-U.S. equities 19% 17% 23%

Fixed income 32% 39% 28%

Real estate 5% 7% 6%

Private equity 7% 4% 1%

Total 100% 100% 100%