Pitney Bowes 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

86

million designated as a net investment hedge. At December 31, 2007, we had two intercompany loans with an outstanding value of

$126.4 million associated with net investment hedges. Net deferred translation gains of $41.7 million and $37.4 million for 2008 and

2007, respectively, were included in accumulated other comprehensive (loss) income in stockholders’ (deficit) equity on the

Consolidated Balance Sheets.

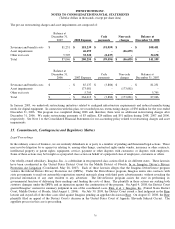

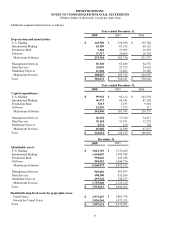

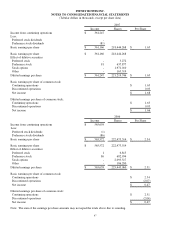

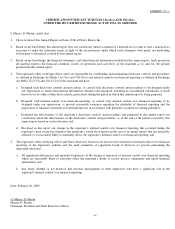

The estimated fair value of our financial instruments follows:

December 31, 2008 December 31, 2007

Carrying

value (1)

Fair value

Carrying

value (1)

Fair value

Investment securities $ 251,298 $ 252,776 $ 200,006 $ 200,005

Loans receivable $ 528,800 $ 528,800 $ 554,370 $ 554,370

Long-term debt $ (3,990,134) $ (3,880,418) $ (3,848,359) $ (3,722,209)

Derivatives, net $ 874 $ 874 $ 7,623 $ 7,623

(1) Carrying value includes accrued interest and deferred fee income, where applicable.

The fair value of long-term debt is estimated based on quoted dealer prices for the same or similar issues. The carrying value for cash,

cash equivalents, accounts receivable, loans receivable, accounts payable and notes payable approximate fair value because of the

short maturity of these instruments.

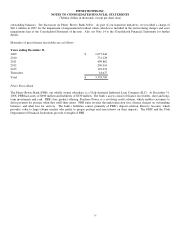

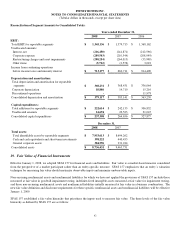

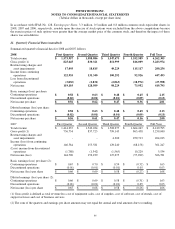

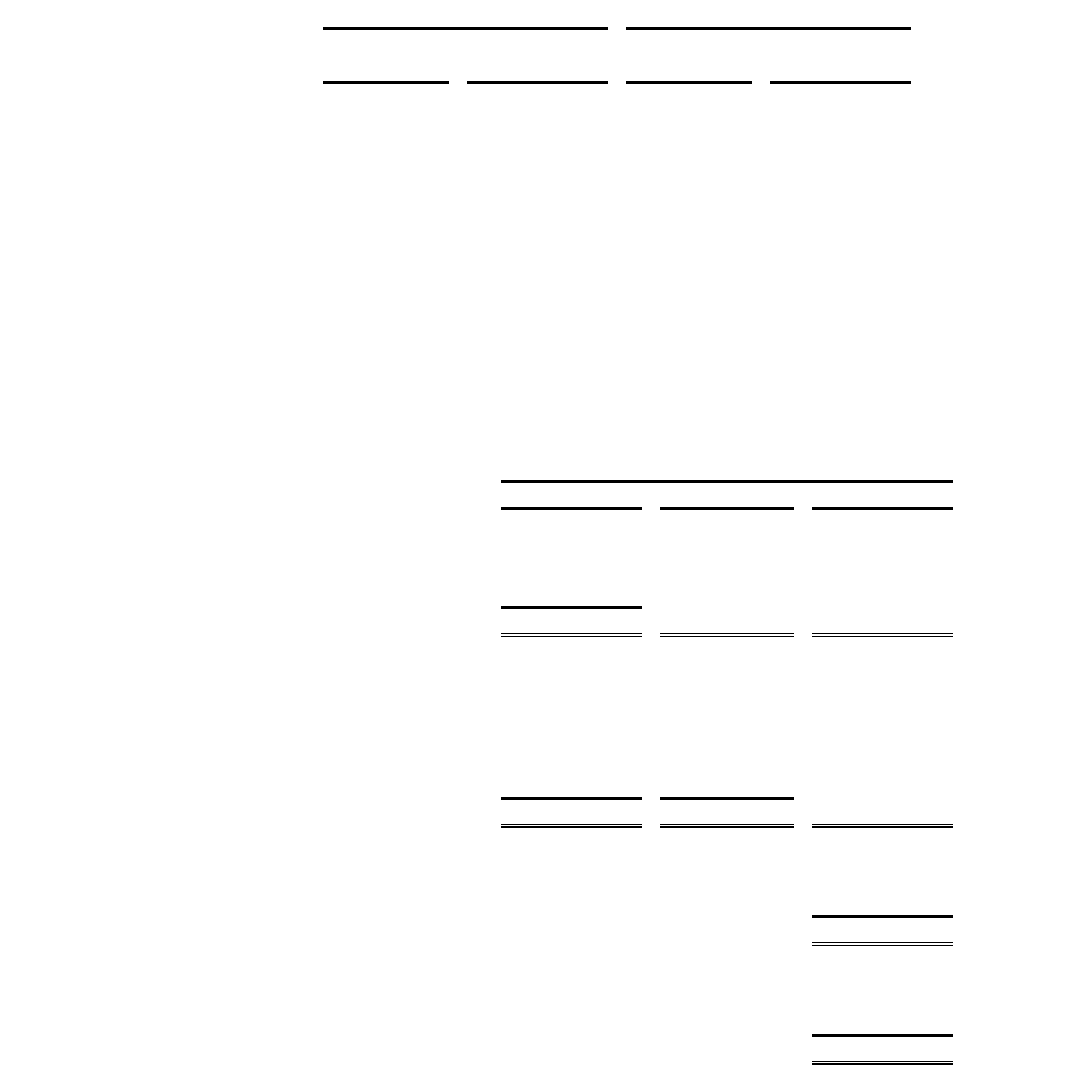

20. Earnings per Share

A reconciliation of the basic and diluted earnings per share computations for income from continuing operations for the years ended

December 31, 2008, 2007 and 2006 is as follows:

2008

Income Shares Per Share

Income from continuing operations $ 447,493

Less:

Preferred stock dividends -

Preference stock dividends (77)

Basic earnings per share $ 447,416 208,425,191 $ 2.15

Basic earnings per share $ 447,416 208,425,191

Effect of dilutive securities:

Preferred stock - 3,272

Preference stock 77 600,733

Stock options - 567,305

Other - 102,970

Diluted earnings per share $ 447,493 209,699,471 $ 2.13

Basic earnings per share of common stock:

Continuing operations $ 2.15

Discontinued operations (0.13)

Net income $ 2.01

Diluted earnings per share of common stock:

Continuing operations $ 2.13

Discontinued operations (0.13)

Net income $ 2.00