Pitney Bowes 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

49

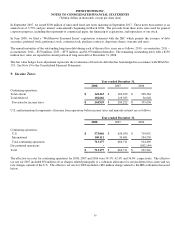

Earnings per Share

Basic earnings per share is based on the weighted average number of common shares outstanding during the year, whereas diluted

earnings per share also gives effect to all dilutive potential common shares that were outstanding during the period. Dilutive potential

common shares include preference stock, preferred stock, stock option and purchase plan shares.

Translation of Non-U.S. Currency Amounts

Assets and liabilities of subsidiaries operating outside the U.S. are translated at rates in effect at the end of the period and revenue and

expenses are translated at average monthly rates during the period. Net deferred translation gains and losses are included in

accumulated other comprehensive income in stockholders’ (deficit) equity in the Consolidated Balance Sheets.

Derivative Instruments

In the normal course of business, the company is exposed to the impact of interest rate changes and foreign currency fluctuations. The

company limits these risks by following established risk management policies and procedures, including the use of derivatives. The

derivatives are used to manage the related cost of debt and to limit the effects of foreign exchange rate fluctuations on financial

results.

In our hedging program, we normally use forward contracts, interest-rate swaps, and currency swaps depending upon the underlying

exposure. We do not use derivatives for trading or speculative purposes. Changes in the fair value of the derivatives are reflected as

gains or losses. The accounting for the gains or losses depends on the intended use of the derivative, the resulting designation, and the

effectiveness of the instrument in offsetting the risk exposure it is designed to hedge.

To qualify as a hedge, a derivative must be highly effective in offsetting the risk designated for hedging purposes. The hedge

relationship must be formally documented at inception, detailing the particular risk management objective and strategy for the hedge.

The effectiveness of the hedge relationship is evaluated on a retrospective and prospective basis.

As a result of the use of derivative instruments, we are exposed to counterparty risk. To mitigate such risks, we enter into contracts

with only those financial institutions that meet stringent credit requirements as set forth in our derivative policy. We regularly review

our credit exposure balances as well as the creditworthiness of our counterparties. See Note 19 to the Consolidated Financial

Statements for additional disclosures on derivative instruments.

New Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation (FIN) No. 48, Accounting for

Uncertainty in Income Taxes (“FIN 48”), which supplements Statement of Financial Accounting Standard No. 109, Accounting for

Income Taxes, by defining the confidence level that a tax position must meet in order to be recognized in the financial statements. FIN

48 requires the tax effect of a position to be recognized only if it is “more-likely-than-not” to be sustained based solely on its technical

merits as of the reporting date. If a tax position is not considered more-likely-than-not to be sustained based solely on its technical

merits, no benefits of the position are recognized. This is a different standard for recognition than was previously required. The more-

likely-than-not threshold must continue to be met in each reporting period to support continued recognition of a benefit. At adoption,

companies adjusted their financial statements to reflect only those tax positions that were more-likely-than-not to be sustained as of

the adoption date. Any necessary adjustment was recorded directly to opening retained earnings in the period of adoption and reported

as a change in accounting principle. We adopted the provisions of FIN 48 on January 1, 2007 which resulted in a decrease to opening

retained earnings of $84.4 million, with a corresponding increase in our tax liabilities.

In September 2006, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 157, Fair Value Measurements

(“SFAS 157”), to define how the fair value of assets and liabilities should be measured in accounting standards where it is allowed or

required. In addition to defining fair value, the Statement established a framework within GAAP for measuring fair value and

expanded required disclosures surrounding fair value measurements. In February 2008, the FASB issued FASB Staff Position (FSP)

FAS 157-2, Effective Date of FASB Statement No. 157, which delayed the effective date by one year for all nonfinancial assets and

nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring basis. In

October 2008, the FASB issued FSP FAS 157-3, Determining the Fair Value of a Financial Asset When the Market for That Asset Is

Not Active. This FSP is effective immediately and includes those periods for which financial statements have not been issued. We

adopted this Statement for financial assets and financial liabilities on January 1, 2008, and the adoption did not have a material impact

on our financial position, results of operations, or cash flows. We do not expect the adoption of this Statement for nonfinancial items

effective January 1, 2009 to have a material impact on our financial position, results of operations, or cash flows. We currently do not