Pitney Bowes 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

57

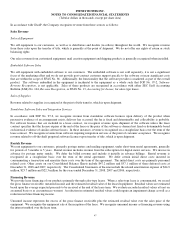

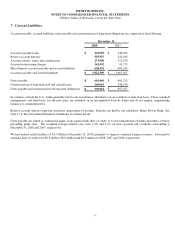

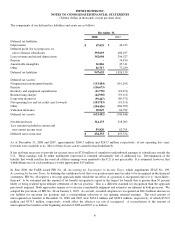

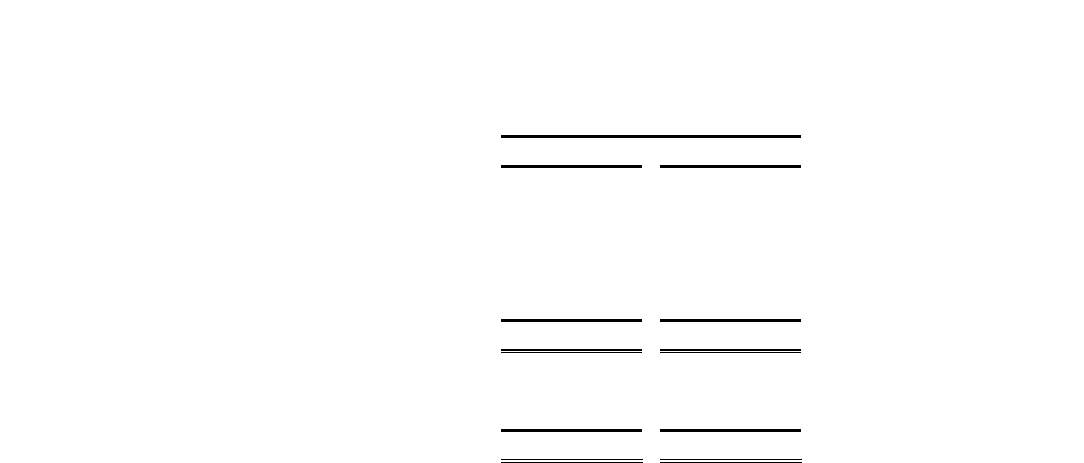

7. Current Liabilities

Accounts payable, accrued liabilities, notes payable and current portion of long-term obligations are composed of the following:

December 31,

2008 2007

Accounts payable-trade $ 323,959 $ 348,293

Reserve account deposits 555,557 522,198

Accrued salaries, wages and commissions 271,940 312,330

Accrued restructuring charges 142,592 91,713

Miscellaneous accounts payable and accrued liabilities 628,351 691,033

Accounts payable and accrued liabilities $ 1,922,399 $ 1,965,567

Notes payable $ 610,460 $ 405,213

Current portion of long-term debt and capital leases 160,041 548,554

Notes payable and current portion of long-term obligations $ 770,501 $ 953,767

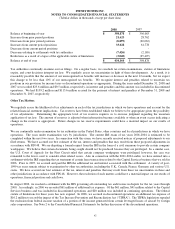

In countries outside the U.S., banks generally lend to our non-finance subsidiaries on an overdraft or term-loan basis. These overdraft

arrangements and term-loans, for the most part, are extended on an uncommitted basis by banks and do not require compensating

balances or commitment fees.

Reserve account deposits represent customers’ prepayment of postage. Deposits are held by our subsidiary, Pitney Bowes Bank. See

Note 17 to the Consolidated Financial Statements for further details.

Notes payable are issued as commercial paper, loans against bank lines of credit, or to trust departments of banks and others at below

prevailing prime rates. The weighted average interest rates were 1.3% and 4.3% on notes payable and overdrafts outstanding at

December 31, 2008 and 2007, respectively.

We had unused credit facilities of $1.5 billion at December 31, 2008, primarily to support commercial paper issuances. Fees paid to

maintain lines of credit were $0.8 million, $0.8 million and $0.9 million in 2008, 2007 and 2006, respectively.