Pitney Bowes 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 22

common stock associated with employee stock plans. We also paid $12 million associated with the redemption of 100% of the

outstanding Cumulative Preferred Stock issued previously by a subsidiary company.

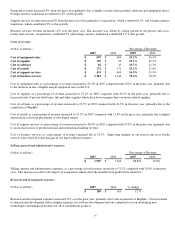

2007 Cash Flows

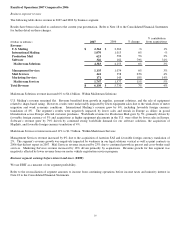

Net cash provided by operations consisted primarily of net income adjusted for non-cash items and changes in operating assets and

liabilities. The strong cash flow provided by operations for 2007 is primarily driven by tax refunds and lower tax payments, lower

investment in finance receivables, and increased management attention on working capital which resulted in lower accounts

receivable, inventory and accounts payable balances.

Net cash used in investing activities consisted of acquisitions of $594 million and capital expenditures of $265 million partially offset

by proceeds from the sale of a training facility for $30 million, proceeds from short-term investments of $42 million, and increased

reserve account balances for customer deposits of $63 million.

Net cash used in financing activities was $204 million and consisted primarily of stock repurchases of $400 million and dividends paid

of $289 million, primarily offset by a net borrowing of debt of $377 million and proceeds from stock issuance of $108 million.

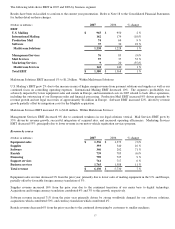

Capital Expenditures

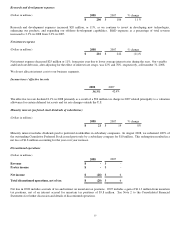

During 2008, capital expenditures included net additions of $122.0 million to property, plant and equipment and $115.3 million in net

additions to rental equipment and related inventories compared with $142.1 million and $122.6 million, respectively, in 2007. The

decrease in property, plant and equipment is due mostly to the continuing shift toward leased equipment in our Management Services

segment.

Financings and Capitalization

We have a commercial paper program that is a significant source of liquidity for the Company. During 2008, we have continued to

have consistent access to the commercial paper market. As of December 31, 2008, we had $610 million of outstanding commercial

paper issuances. We also have a committed line of credit of $1.5 billion which supports commercial papers issuance and is provided

by a syndicate of 14 banks until 2011. As of December 31, 2008, this line of credit had not been drawn down. In addition, we filed a

“Well-known Seasoned Issuer” registration statement with the SEC in June 2008 which permits the issuance of debt securities,

preferred stock, preference stock, common stock, purchase contracts, depositary shares, warrants and units.

On March 4, 2008, we issued $250 million of 10 year fixed rate notes with a coupon rate of 5.60%. The interest is paid semi-annually

beginning September 2008. The notes mature on March 15, 2018. We simultaneously entered into two interest rate swaps for a total

notional amount of $250 million to convert the fixed rate debt to a floating rate obligation bearing interest at 6 month LIBOR plus

111.5 basis points. The proceeds from these notes were used for general corporate purposes, including the repayment of commercial

paper and repurchase of our stock.

In December 2007, we entered into a $150 million syndicated bank transaction priced at 3 month LIBOR plus 35 basis points. The

proceeds from this credit facility, due 2012, were used to pay off the $150 million variable rate debt that was due in 2010.

In September 2007, we issued $500 million of unsecured fixed rate notes maturing in September 2017. These notes bear interest at an

annual rate of 5.75% and pay interest semi-annually beginning in March 2008. The proceeds from these notes were used for general

corporate purposes, including the repayment of commercial paper, the financing of acquisitions and repurchase of our stock.

We believe our financing needs in the short and long-term can be met from cash generated internally, borrowing capacity from

existing credit agreements, available debt issuances under existing shelf registration statements and our existing commercial paper

program. Information on debt maturities is presented in Note 8 to the Consolidated Financial Statements.