Pitney Bowes 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

48

We provide financing to our customers for the purchase of postage and related supplies. Financing revenue includes interest which is

earned over the term of the loan and related fees which are recognized as services are provided.

Support Services Revenue

We provide support services for our equipment primarily through maintenance contracts. Revenue related to these agreements is

recognized on a straight-line basis over the term of the agreement, which typically is 1 to 5 years in length.

Business Services Revenue

Business services revenue includes revenue from management services, mail services, and marketing services. Management services,

which includes outsourcing of mailrooms, copy centers, or other document management functions, are typically 1 to 5 year contracts

that contain a monthly service fee and in many cases a “click” charge based on the number of copies made, machines in use, etc.

Revenue is recognized over the term of the agreement, based on monthly service charges, with the exception of the “click” charges,

which are recognized as earned. Mail services include the preparation, sortation and aggregation of mail to earn postal discounts and

expedite delivery and revenue is recognized as the services are provided. Marketing services include direct mail marketing services,

and revenue is recognized over the term of the agreement as the services are provided.

Multiple Element Arrangements

Certain of our transactions are consummated at the same time. The most common form of these transactions involves the sale or lease

of equipment, a meter rental and/or an equipment maintenance agreement. In these cases, revenue is recognized for each of the

elements based on their relative fair values in accordance with SFAS No. 13, Emerging Issues Task Force (EITF) No. 00-21,

Accounting for Revenue Arrangements with Multiple Deliverables, and SAB No. 104. Fair values of any meter rental or equipment

maintenance agreement are determined by reference to the prices charged in standalone and renewal transactions. Fair value of

equipment is determined based upon the present value of the minimum lease payments.

Deferred Marketing Costs

We capitalize certain direct mail, telemarketing, Internet, and retail marketing costs, associated with the acquisition of new customers

in accordance with SOP No. 93-7, Reporting on Advertising Costs. These costs are amortized over the expected revenue stream

ranging from 5 to 9 years. We review individual marketing programs for impairment on a periodic basis or as circumstances warrant.

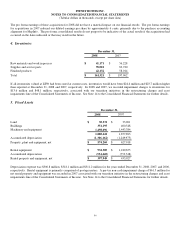

Other assets on our Consolidated Balance Sheets at December 31, 2008 and 2007 include $130.8 million and $135.7 million,

respectively, of deferred marketing costs. The Consolidated Statements of Income include the related amortization expense of $43.1

million, $43.7 million and $49.6 million for the years ended December 31, 2008, 2007 and 2006, respectively.

Restructuring Charges

We apply the provisions of SFAS No. 146, Accounting for Costs Associated with Exit or Disposal Activities, to account for one-time

benefit arrangements and exit or disposal activities. SFAS No. 146 requires that a liability for costs associated with an exit or disposal

activity be recognized when the liability is incurred. We account for ongoing benefit arrangements under SFAS No. 112, Employers’

Accounting for Postemployment Benefits, which requires that a liability be recognized when the costs are probable and reasonably

estimable. See Note 14 to the Consolidated Financial Statements.

Income Taxes

We recognize deferred tax assets and liabilities for the future tax consequences attributable to differences between the financial

statements carrying amounts of existing assets and liabilities and their respective tax bases. A valuation allowance is provided when it

is more likely than not that some portion or all of a deferred tax asset will not be realized. The ultimate realization of deferred tax

assets depends on the generation of future taxable income during the period in which related temporary differences become

deductible. We consider the scheduled reversal of deferred tax liabilities, projected future taxable income and tax planning strategies

in this assessment. Deferred tax assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in

the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities

of a change in tax rates is recognized in income in the period that includes the enactment date of such change.