Pitney Bowes 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

85

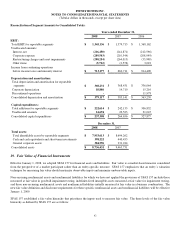

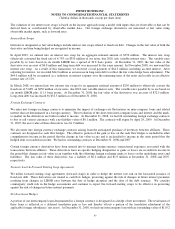

The valuation of our interest rate swaps is based on the income approach using a model with inputs that are observable or that can be

derived from or corroborated by observable market data. Our foreign exchange derivatives are measured at fair value using

observable market inputs, such as forward rates.

Interest Rate Swaps

Derivatives designated as fair value hedges include interest rate swaps related to fixed rate debt. Changes in the fair value of both the

derivative and item being hedged are recognized in income.

In April 2003, we entered into an interest rate swap for an aggregate notional amount of $350 million. The interest rate swap

effectively converted the fixed rate of 4.75% on $350 million of our notes, due 2018, into variable interest rates. The variable rates

payable by us were based on six month LIBOR less a spread of 22.8 basis points. At December 31, 2007, the fair value of the

derivative was an asset of $6.8 million and long-term debt was increased by the same amount. In November 2008, we unwound this

interest rate swap. As a result of this transaction, we received a total payment of $44.2 million, including accrued interest. After

adjusting for interest, we recorded $44.0 million as an increase in long-term debt to reflect the fair value hedge basis adjustment. The

$44.0 million will be recognized as a reduction in interest expense over the remaining term of the notes and results in an effective

interest rate of 3.2%.

In March 2008, we entered into two interest rate swaps for an aggregate notional amount of $250 million to effectively convert the

fixed rate of 5.60% on $250 million of our notes, due 2018, into variable interest rates. The variable rates payable by us are based on

six month LIBOR plus 111.5 basis points. At December 31, 2008, the fair value of the derivatives was an asset of $32.5 million.

Long-term debt was increased by $32.5 million as of December 31, 2008.

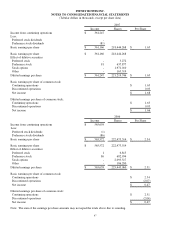

Foreign Exchange Contracts

We enter into foreign exchange contracts to minimize the impact of exchange rate fluctuations on inter-company loans and related

interest that are denominated in a foreign currency. The revaluation of the short-term inter-company loans and interest and the mark-

to-market on the derivatives are both recorded to income. At December 31, 2008, we had 24 outstanding foreign exchange contracts

to buy or sell various currencies with a net liability value of $0.1 million. The contracts will expire by April 29, 2009. At December

31, 2007, the asset value of these derivatives was $1.9 million.

We also enter into foreign currency exchange contracts arising from the anticipated purchase of inventory between affiliates. These

contracts are designated as cash flow hedges. The effective portion of the gain or loss on the cash flow hedges is included in other

comprehensive income in the period that the change in fair value occurs and is reclassified to income in the same period that the

hedged item is recorded in income. We had no outstanding contracts at December 31, 2008 and 2007.

Certain foreign currency derivatives have been entered into to manage foreign currency transactional exposures associated with the

transactions between affiliates. These derivatives have no specific hedging designation so gains or losses are recorded in income in

the period that changes in fair value occur together with the offsetting foreign exchange gains or losses on the underlying assets and

liabilities. The fair value of these derivatives was a liability of $0.2 million and $1.9 million at December 31, 2008 and 2007,

respectively.

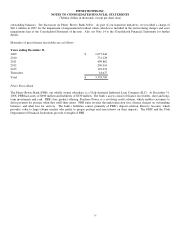

Treasury Lock & Forward Starting Swap Agreements

We utilize forward starting swap agreements (forward swaps) in order to hedge the interest rate risk on the forecasted issuance of

fixed-rate debt. These derivatives are treated as cash flow hedges, protecting against the risk of changes in future interest payments

resulting from changes in LIBOR rates between the date of hedge inception and the date of the debt issuance. We consider

counterparty credit risk in the hedge assessments and continue to expect the forward-starting swaps to be effective in protecting

against the risk of changes in future interest payments.

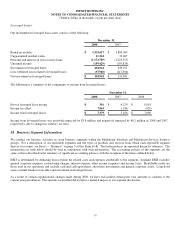

Net Investment Hedges

A portion of our intercompany loans denominated in a foreign currency is designated as a hedge of net investment. The revaluation of

these loans is reflected as a deferred translation gain or loss and thereby offsets a portion of the translation adjustment of the

applicable foreign subsidiaries’ net assets. At December 31, 2008, we had one intercompany loan with an outstanding value of $119.2